R&D Investment

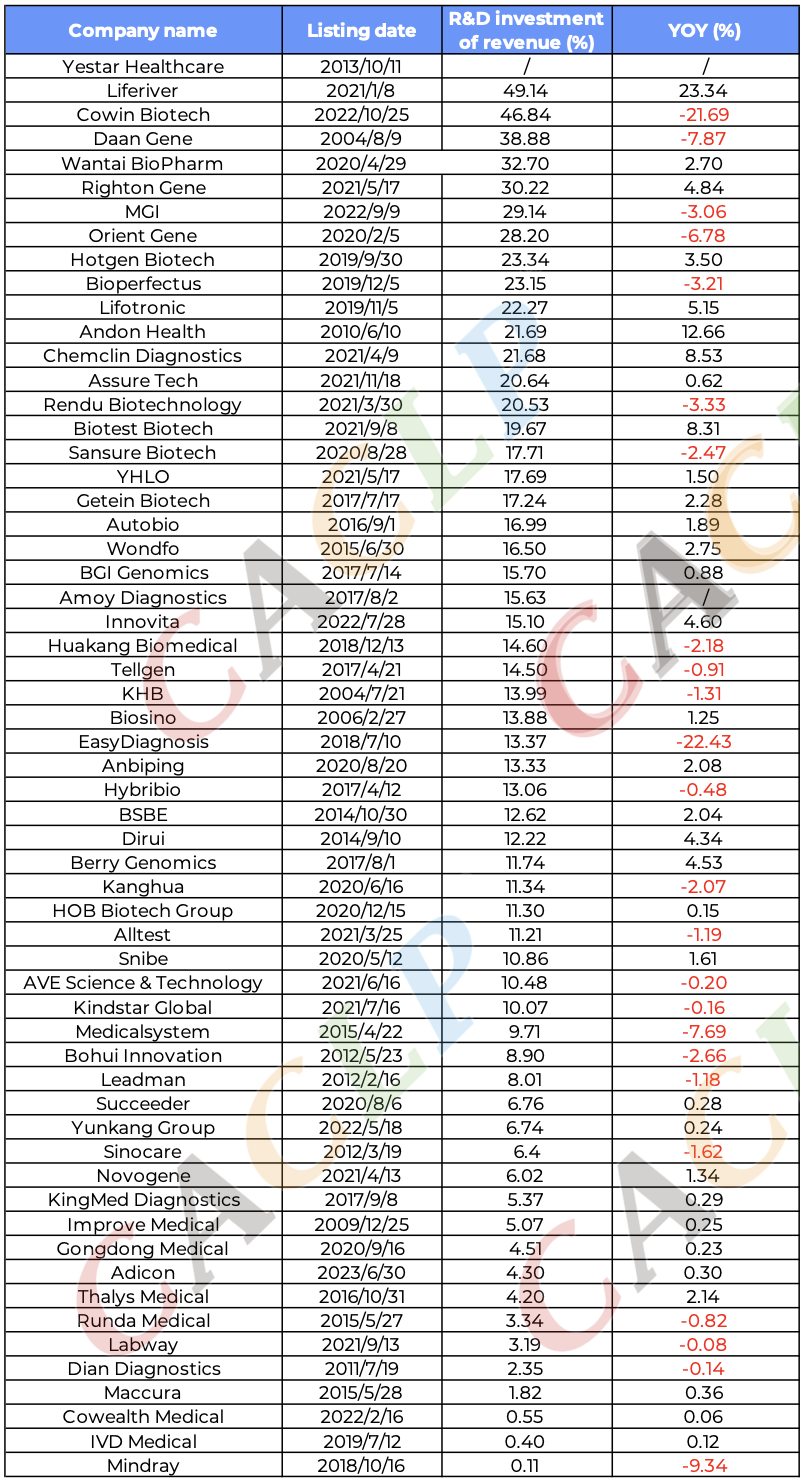

Overview of R&D Investment by Leading IVD Companies in 2025 H1

* The above table is ranked from highest to lowest based on annual R&D expenditure as a percentage of revenue

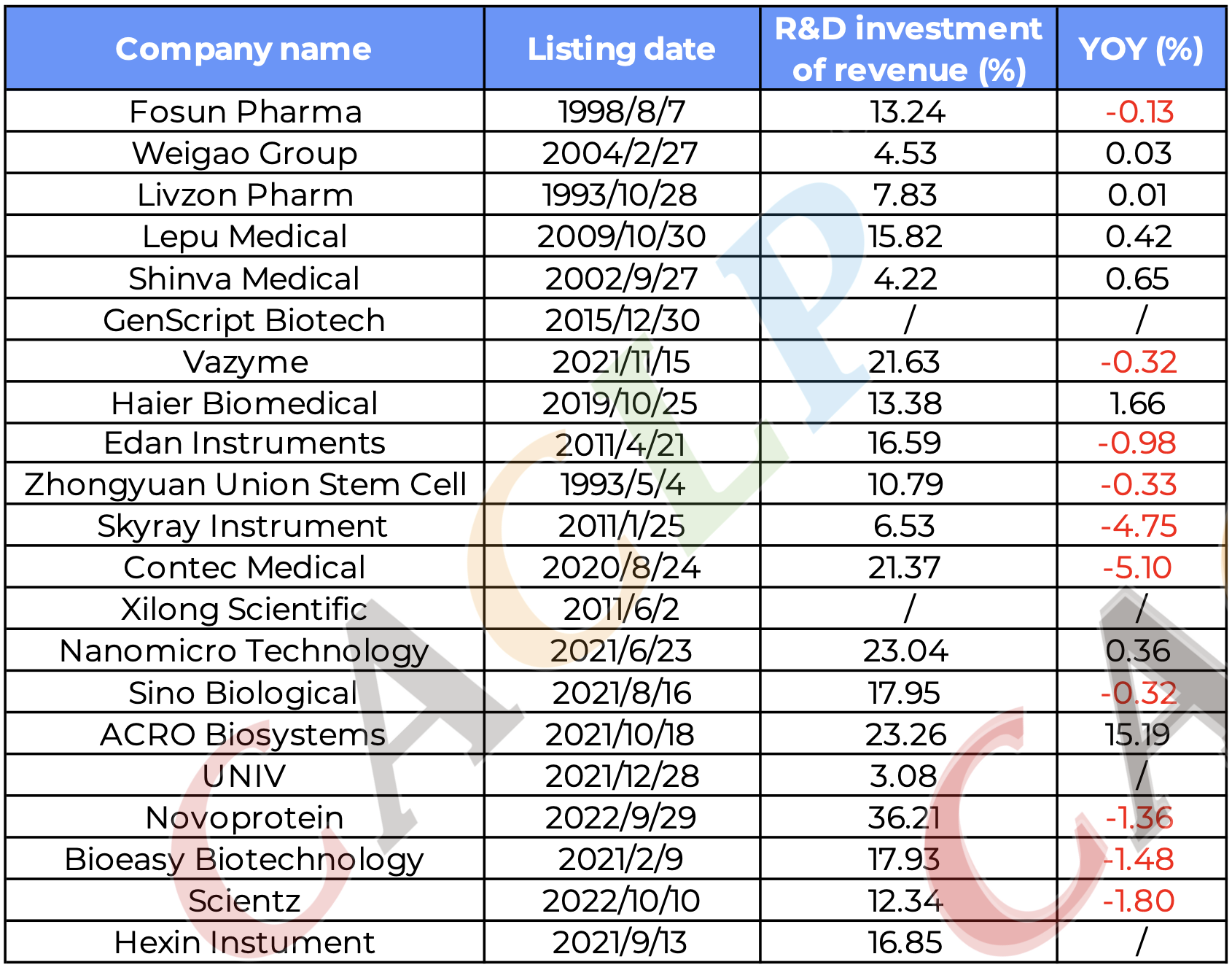

Overview of R&D Investment by IVD-Related Companies in 2025 H1

* The above table is ranked from highest to lowest based on annual R&D expenditure as a percentage of revenue

Nineteen companies reported R&D-to-revenue ratios above 20% in H1 2025. Roughly 42.5% of IVD companies increased their R&D spending compared to revenue. Liferiver ranked highest, with R&D spending equal to 49.14% of revenue, significantly above the industry average. The company focused on molecular diagnostics, antibody drug R&D, and precision medicine, although its revenue fell 36.9%, leading to losses. Nevertheless, its aggressive investment is laying a foundation for technical barriers in infectious disease testing and cancer early screening.

Overall, leading companies are increasing R&D investment to build technological moats as the sector accelerates toward automation, multiplex testing, and precision medicine. For large players, the “R&D – innovation – market expansion” cycle is reinforcing competitiveness in molecular diagnostics and high-end devices. Smaller firms are seeking breakthroughs in niche fields to secure survival. Supported by favorable policies and globalization, this trend will continue to drive the industry toward smarter, more precise diagnostics.

Last: A Mid-Year Look at 80 Chinese IVD Companies’ H1 Financial Reports Section 1

Next: A Mid-Year Look at 80 Chinese IVD Companies’ H1 Financial Reports Section 3

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back