As of August 31, 2025, China has 83 publicly listed companies related to in vitro diagnostics (IVD), including 62 whose core business is IVD and 21 with IVD-related operations. Among the 62 core IVD companies, 59 have disclosed their 2025 half-year reports.

Revenue Performance

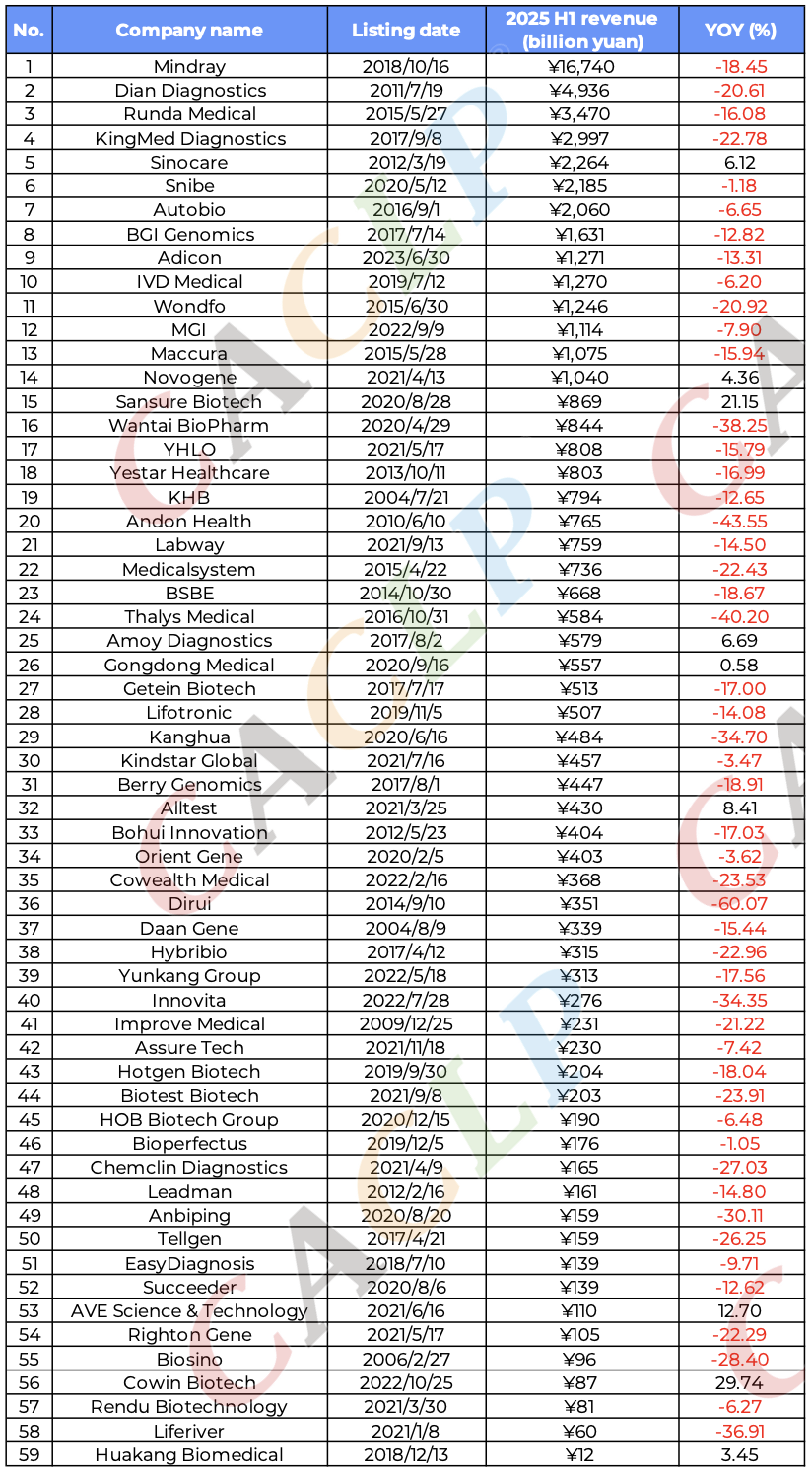

The 59 IVD-focused listed companies reported a combined revenue of RMB 60.377 billion in the first half of 2025. Mindray, Dian Diagnostics, and Runda Medical ranked as the top three by revenue. The data shows that the IVD sector is still undergoing structural adjustment, with many companies experiencing year-on-year declines. Overall revenue pressure remained evident in H1. Mindray’s IVD revenue reached RMB 16.74 billion, leading the industry, though with slower growth. Traditional independent clinical laboratory leaders such as Dian Diagnostics and Runda Medical maintained high revenue levels but faced ongoing profitability challenges. Meanwhile, companies such as Maccura, YHLO, and Autobio delivered stronger overseas performance, with international revenue growth becoming a key highlight. With volume-based procurement policies advancing and companies accelerating their shift toward innovative products, advanced technologies, and global markets, the industry remains in a critical phase of transformation and recovery.

Table of Total Operating Revenue for Leading IVD Companies in 2025 H1

*The above table is ranked in descending order based on annual total revenue.

Only nine of the 59 IVD companies achieved year-on-year revenue growth. Sansure Biotech and Cowin Biotech stood out with growth above 20%. Sansure’s gains came mainly from mergers, acquisitions, and global expansion—its January acquisition of Sansure Hygene contributed RMB 240 million, while overseas revenue grew more than 60% thanks to partnerships with medical institutions in Thailand and beyond. Cowin Biotech leveraged product innovation, notably securing China’s first stool-based drug-resistance test for Helicobacter pylori in late 2024. Rising sales of molecular detection reagents and nucleic acid preservation kits offset pricing pressure, pushing revenue growth above 20%. Both companies also aligned workforce expansion with business needs, showing how innovation drives both revenue and employment growth.

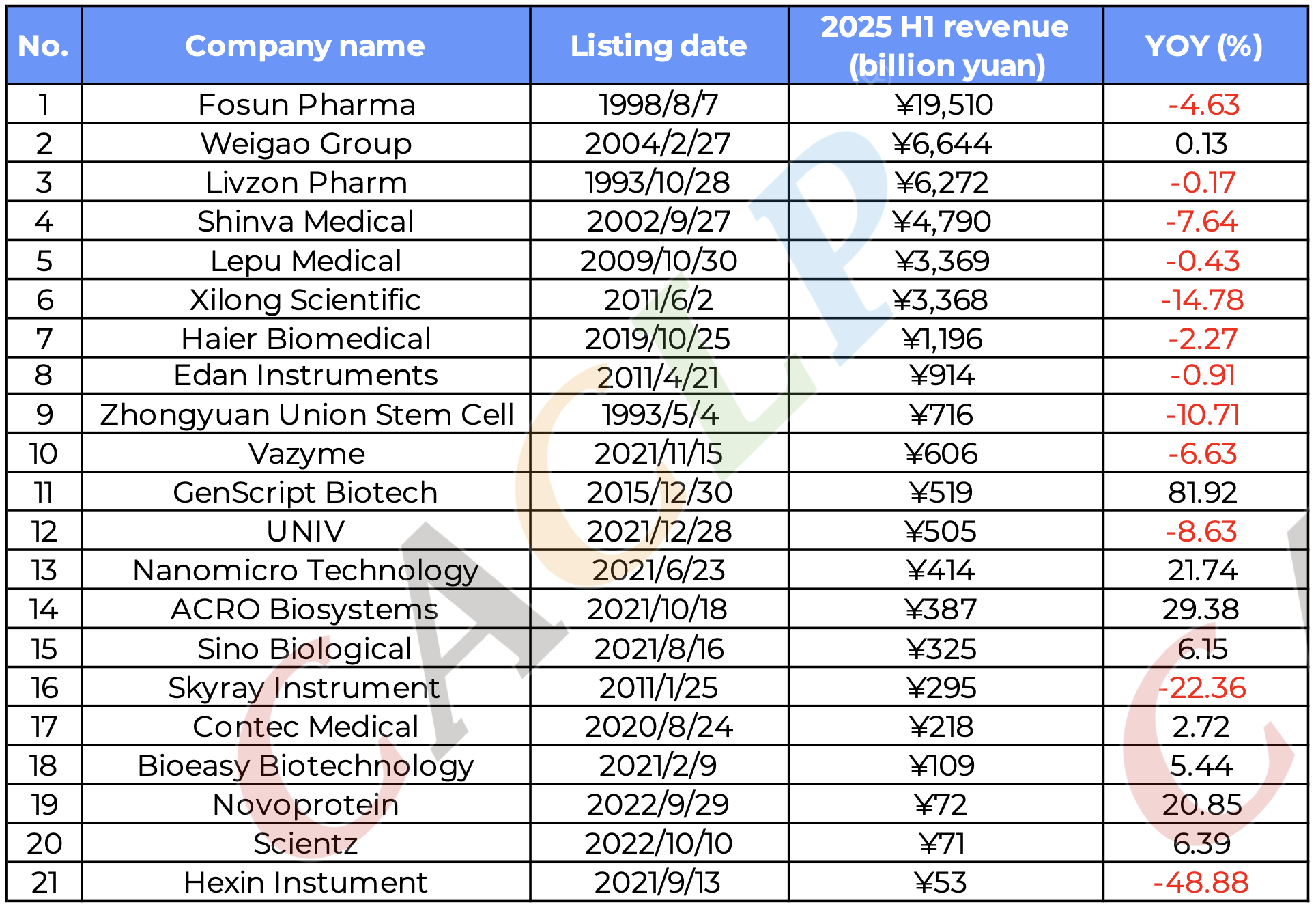

Table of Total Operating Revenue for IVD-Related Companies in 2025 H1

*The above table is ranked in descending order based on annual total revenue.

Among the 21 IVD-related listed firms, Fosun Pharma remained the leader with half-year revenue of RMB 19.51 billion. In the diagnostics segment, Livzon Pharma and Edan Instruments showed steady but slightly declining results—RMB 374 million (–5.13%) and RMB 191 million (–2.95%), respectively. The drop was largely attributed to domestic price cuts under volume-based procurement, product transition phases, and cyclical industry factors. Workforce levels at Lepu Medical and Edan remained stable, reflecting a balance between business operations and human resources.

Next: A Mid-Year Look at 80 Chinese IVD Companies’ H1 Financial Reports Section 2

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back