Overseas Revenue

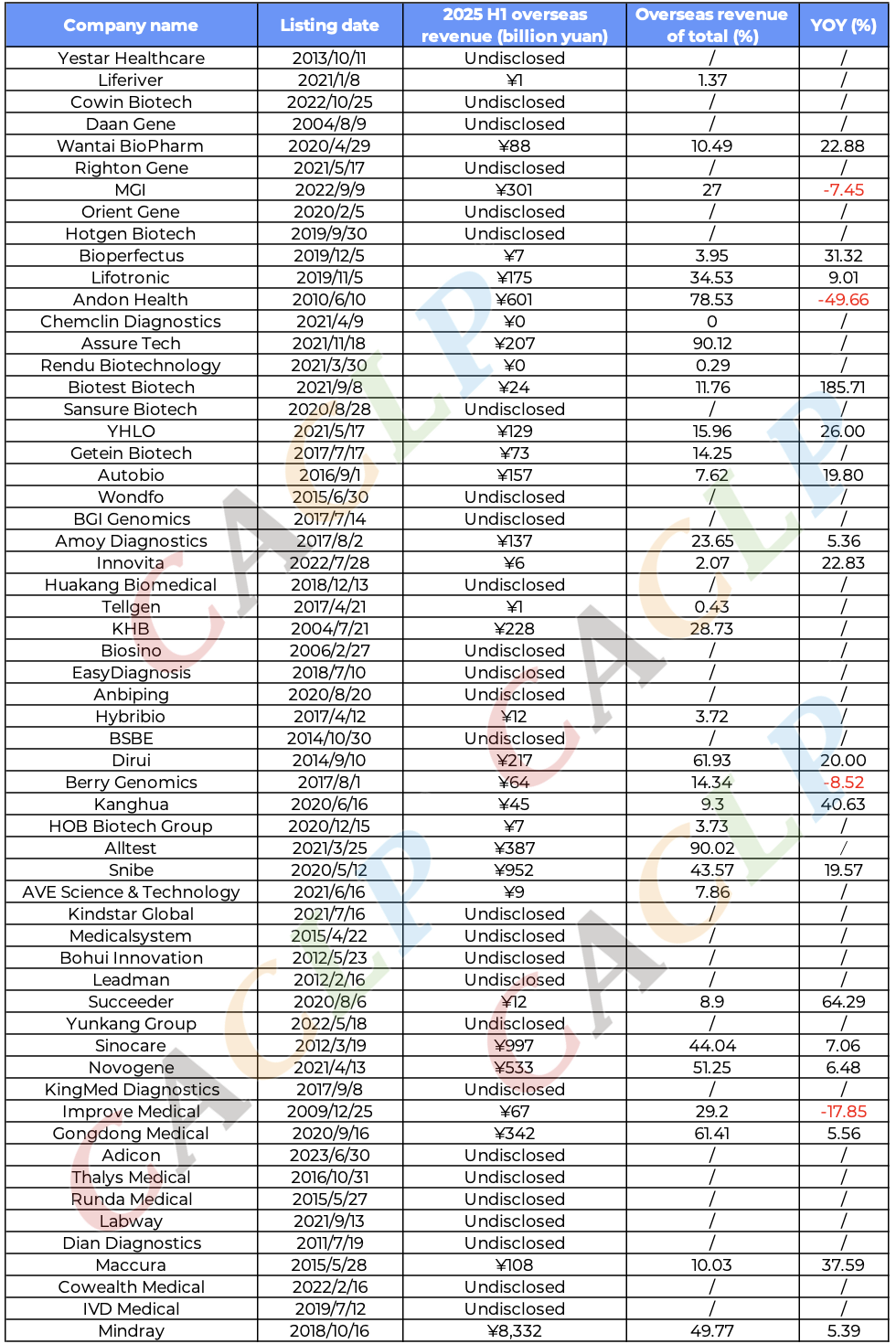

Table of Overseas Revenue for Leading IVD Companies in 2025 H1

*The above table is sorted by overseas revenue from highest to lowest

International business has become a key performance driver. Mindray generated RMB 8.33 billion in overseas revenue, accounting for 49.77% of its total, up 5.39% year-on-year. Assure Tech and Alltest reported over 90% of revenue from abroad, while Cowin Biotech grew overseas revenue 40.83%. Conversely, Andon Health’s overseas revenue, mostly from the U.S., fell nearly 50% as COVID-19 test demand plummeted. Heavy reliance on single markets and product lines has left some companies vulnerable. In contrast, leaders like Mindray and Snibe are mitigating risks through diversified markets and product portfolios.

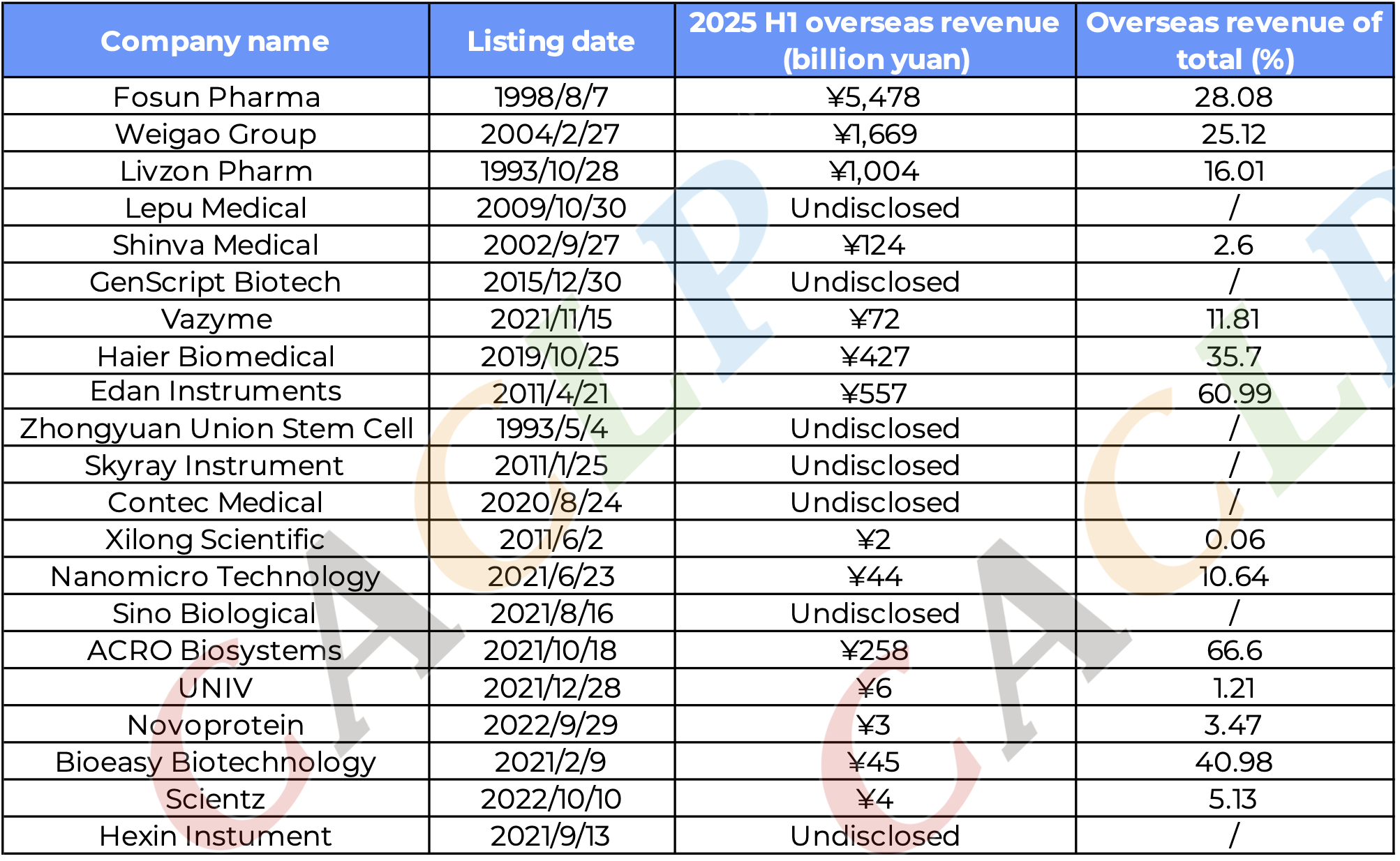

Table of Overseas Revenue for IVD-Related Companies in 2025 H1

*The above table is sorted by overseas revenue from highest to lowest

Among IVD-related firms, Fosun Pharma led with RMB 5.478 billion in overseas revenue (28.08% of total). Weigao Group reported RMB 1.669 billion (–2.96%), while Livzon (RMB 1.004 billion, +18.4%) and Edan (RMB 557 million, +8.33%) benefited from expanded international sales of reagents and diagnostic products. The trend underscores that technology-driven companies are capturing growth abroad, while traditional players face pressure in international competition.

Industry Outlook

The half-year reports from 59 IVD-focused and 21 IVD-related listed companies highlight structural divergence in the industry. Some, like Dian Diagnostics and KingMed, saw revenues and profits decline due to post-pandemic normalization and heightened competition. Yet Mindray continued steady growth with its strong product portfolio and overseas expansion. Autobio and Snibe advanced in chemiluminescence and automation, while Sinocare, Sansure, and Novogene delivered growth in blood glucose monitoring, molecular diagnostics, and gene sequencing.

Overseas markets are emerging as critical growth engines, with international revenue ratios climbing at leading firms. Meanwhile, R&D investment remains high across the sector, with most top companies spending over 10% of revenue on innovation in chemiluminescence, molecular diagnostics, POCT, and automation.

In short, despite short-term pressures and mixed results, the long-term fundamentals for China’s IVD sector remain unchanged. Population aging, rising demand for precision medicine, and supportive policies for domestic innovation will continue to drive growth. By upgrading products, integrating supply chains, and expanding overseas, Chinese IVD companies are moving from scale-driven expansion toward a future led by innovation and quality.

Last: A Mid-Year Look at 80 Chinese IVD Companies’ H1 Financial Reports Section 3

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back