Original from: Roche

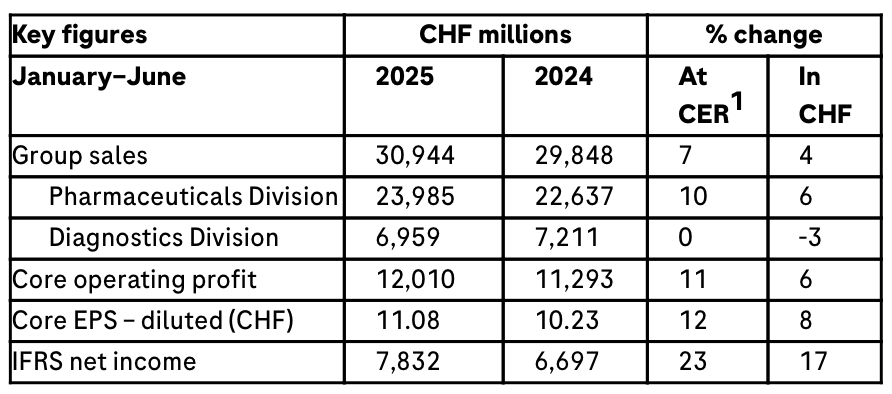

· Group sales grew by 7% at constant exchange rates (CER; 4% in CHF), driven by strong demand for medicines.

· Pharmaceuticals Division sales rose by 10% (6% in CHF), with Phesgo (breast cancer), Xolair (food allergies), Hemlibra (haemophilia A), Vabysmo (severe eye diseases) and Ocrevus (multiple sclerosis) being the top growth drivers.

· Diagnostics Division sales were stable (-3% in CHF) as strong demand for pathology solutions and blood screening tests offset the impact of healthcare pricing reforms in China.

· Core operating profit increased by 11% (6% in CHF), driven by higher sales and effective cost management.

· Core earnings per share showed significant growth of 12% (8% in CHF); IFRS net income jumped by 23% (17% in CHF).

· Outlook for 2025 confirmed.

· Highlights:

- US approval for Susvimo for diabetic retinopathy, a potentially blinding eye disease

- EU approval for Itovebi for a type of advanced breast cancer and Evrysdi tablet for spinal muscular atrophy

- CHMP recommendation for EU label update for Phesgo for breast cancer to allow at-home administration

- Advancement of key molecules into phase III development: prasinezumab for early-stage Parkinsonߴs disease and zosurabalpin for life-threatening bacterial infections

- Positive data on several therapies: Lunsumio and Polivy combination and Columvi for blood cancer, Tecentriq for lung cancer, Itovebi and Perjeta for breast cancer and fenebrutinib for multiple sclerosis and NXT007 for haemophilia A

- Introduction of innovative Elecsys PRO-C3 test to improve precision in evaluating liver fibrosis severity

- Announcement of new collaboration with Broad Clinical Labs to accelerate adoption of cutting-edge SBX sequencing technology

- US approval for VENTANA MET (SP44) RxDx Assay as the first companion diagnostic to identify a form of lung cancer in patients eligible for targeted treatment

- US Breakthrough Device Designation for first AI-driven companion diagnostic for non-small cell lung cancer

Outlook for 2025 confirmed

Roche (SIX: RO, ROG; OTCQX: RHHBY) expects an increase in Group sales in the mid single digit range (CER). Core earnings per share are targeted to develop in the high single digit range (CER). Roche expects to further increase its dividend in Swiss francs.

Roche CEO Thomas Schinecker: “Roche’s strong growth momentum continued in the second quarter, driven by the strong growth of 11% at constant exchange rates in our Pharmaceuticals Division.

We received numerous important approvals and reported positive data in disease areas with high unmet medical need.

Over the past six months, we have made significant progress in our pipeline and advanced four potentially practice-changing therapies into the final phase of clinical development, based on encouraging data: NXT007 in haemophilia A, trontinemab in Alzheimer’s disease, prasinezumab in early-stage Parkinson’s disease, and zosurabalpin, a novel antibiotic that could become the first in over 50 years to tackle a type of bacteria that has become resistant to most other treatments.

We are confident in our continued strong momentum and resilience of our business due to our innovative on-market portfolio and pipeline.

Based on these strong results, we confirm our full-year outlook.”

Group results

In the first half of 2025, Roche achieved sales growth of 7% (4% in CHF) to CHF 30.9 billion due to strong demand for pharmaceutical products.

Core operating profit increased by 11% (6% in CHF) to CHF 12.0 billion, driven by higher sales and effective cost management.

The appreciation of the Swiss franc against most currencies, notably the US dollar, had an adverse impact on the results when reported in Swiss francs compared to constant exchange rates.

Core earnings per share increased by 12% (8% in CHF).

IFRS net income increased by 23% (17% in CHF) to CHF 7.8 billion, driven by the strong operating performance and lower impairment charges related to intangible assets.

Sales in the Pharmaceuticals Division increased by 10% (6% in CHF) to CHF 24.0 billion, with medicines for severe diseases continuing their strong growth.

The top five growth drivers – Phesgo, Xolair, Hemlibra, Vabysmo and Ocrevus – achieved total sales of CHF 10.6 billion. This represents an increase of CHF 1.7 billion at CER compared to the first half of 2024.

This more than compensated for the total decrease of CHF 0.3 billion (CER) in sales of the ‘loss of exclusivity (LOE)’ products – the decline in sales of Avastin (various types of cancer), Herceptin (breast and gastric cancer), MabThera/Rituxan (blood cancer, rheumatoid arthritis), Lucentis (severe eye diseases) and Esbriet (lung disease) was partially offset by an increase in sales of Actemra/RoActemra (rheumatoid arthritis).

In the United States, sales rose by 10% due to continued growth of Xolair and continuing uptake of Hemlibra, Ocrevus, Vabysmo and Phesgo. This growth more than compensated for the decline in sales of medicines with expired patents.

Sales in Europe grew 5% as the continued roll-out of Vabysmo and the continuing uptake of Ocrevus, Polivy and Phesgo more than compensated for lower sales of Perjeta (breast cancer) due to ongoing conversion of patients to Phesgo and the impact of biosimilar competition on Actemra/RoActemra sales.

In Japan, sales increased by 5%, mainly due to the strong uptake of Phesgo, Vabysmo and PiaSky (paroxysmal nocturnal haemoglobinuria). Sales growth was partially offset by the decline in sales of Perjeta due to continued conversion of patients to Phesgo and of Avastin because of biosimilar erosion.

Sales in the International region grew by 14%, led by Phesgo, Hemlibra, Xofluza (influenza), Vabysmo and Elevidys (Duchenne muscular dystrophy). In China, sales rose by 9%, driven by the uptake of Phesgo, strong sales of Xofluza and the roll-out of Polivy and Vabysmo.

The Diagnostics Division’s sales remained stable (-3% in CHF) at CHF 7.0 billion as growth in demand for pathology solutions and blood screening tests offset the impact of healthcare pricing reforms in China.

Sales in the Europe, Middle East and Africa (EMEA) region increased by 5%, driven by higher sales of clinical chemistry and immunodiagnostic products. In North America, sales increased by 6%, with growth across customer areas. Sales in Asia-Pacific decreased by 15% due to healthcare pricing reforms in China. Latin America sales grew by 14%.

Source: Roche continues strong momentum with 7% growth (CER) in the first half of 2025

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back