Original from: Lucid Diagnostics

Lucid Diagnostics Inc. (Nasdaq: LUCD) ("Lucid" or the "Company") a commercial-stage, cancer prevention medical diagnostics company, and subsidiary of PAVmed Inc. (Nasdaq: PAVM) ("PAVmed"), today provided a business update for the Company and reported financial results for the three months ended June 30, 2025.

Business Highlights

"We are looking forward to the upcoming MolDx CAC meeting—a significant milestone and strong indicator that we are entering the final stages of securing positive Medicare coverage for EsoGuard," said Lishan Aklog, M.D., Lucid's Chairman and Chief Executive Officer. "We are confident that participating medical experts—with deep domain expertise and real-world experience in nonendoscopic esophageal precancer testing—will provide strong public support for the clinical utility of EsoGuard. Our strengthened balance sheet, ongoing commercial execution, and new initiatives targeting the Medicare population, have us well-positioned to accelerate EsoGuard commercialization as Medicare coverage and other upcoming reimbursement milestones are achieved."

· Processed 2,756 EsoGuard® Esophageal DNA Tests in 2Q25.

· Recognized $1.2 million in EsoGuard revenue for 2Q25.

· MolDX‑participating Medicare Administrative Contractors (MACs)—Palmetto GBA, CGS Administrators, Noridian Healthcare Solutions, and WPS Government Health Administrators—to convene a Contractor Advisory Committee (CAC) meeting of medical experts on September 4, 2025 to review and discuss the clinical evidence related to Local Coverage Determination (LCD) L39256 for EsoGuard, as part of the reconsideration process requested by Lucid in November 2024.

· Strengthened balance sheet with underwritten public offering of common stock, netting approximately $16.1 million in proceeds; ended 2Q25 with over $30 million in proforma cash, extending runway into 2026.

· Initiated patient testing and billing under first positive commercial insurance coverage policy for EsoGuard from Highmark Blue Cross Blue Shield, which became effective May 26, 2025.

· Partnered with Hoag, a nationally-recognized regional healthcare delivery network, to launch a comprehensive EsoGuard esophageal precancer testing program, expanding access to at-risk patients across its digestive health, primary care, and concierge medicine programs.

· NCI‑sponsored study demonstrating that EsoGuard effectively detects esophageal precancer in at‑risk patients without GERD symptoms published in the peer‑reviewed American Journal of Gastroenterology, supporting expanded indication and a potential market opportunity increase of up to 70%.

· Joined the Russell 2000® and Russell 3000® Indexes, effective June 27, 2025, enhancing visibility and access to a broader base of institutional investors.

Financial Results

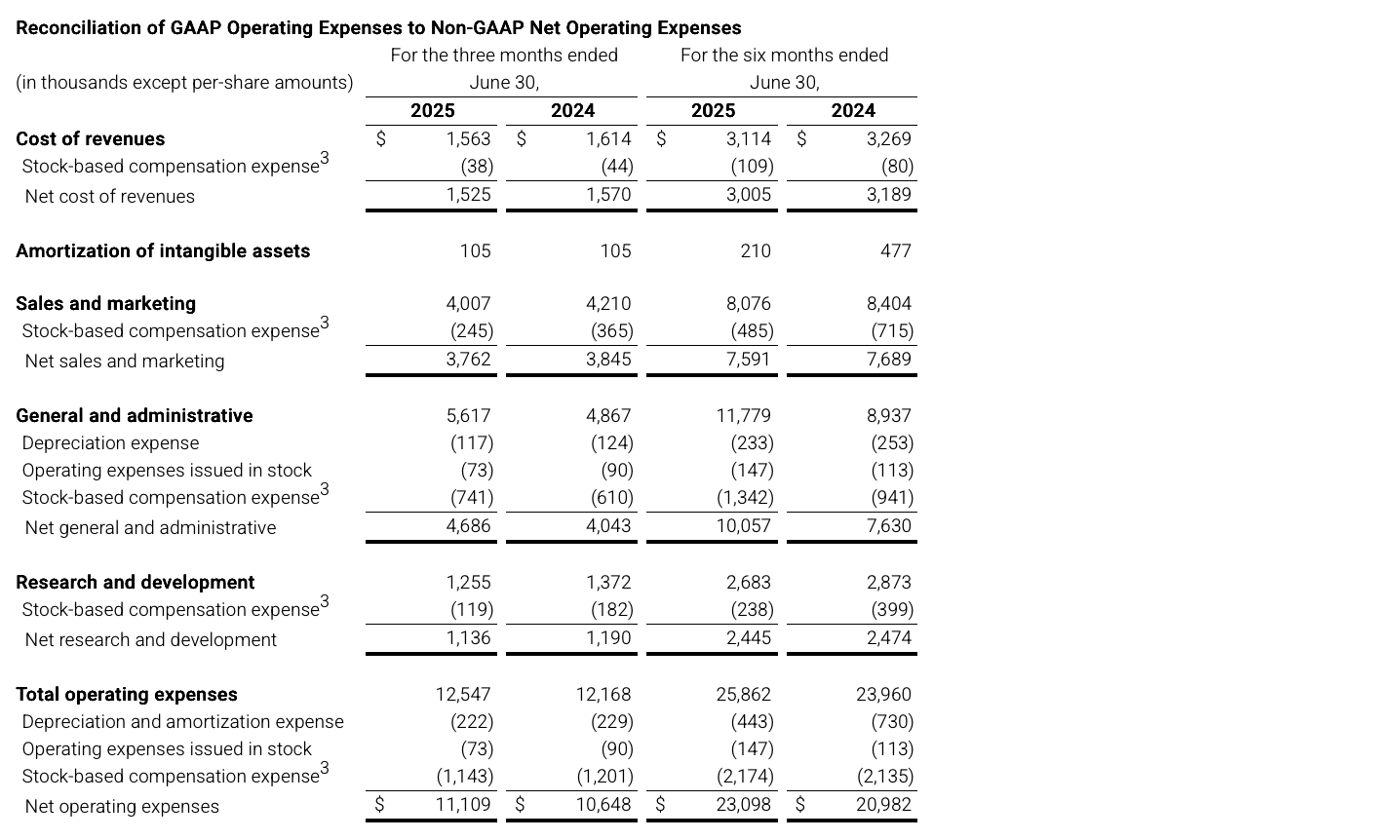

· For the three months ended June 30, 2025, EsoGuard related revenues were $1.2 million. Operating expenses were approximately $12.5 million, which included stock-based compensation expenses of $1.1 million. GAAP net loss attributable to common stockholders was approximately $7.9 million or $(0.08) per common share.

· As shown below and for the purpose of illustrating the effect of stock-based compensation and other non-cash income and expenses on the Company's financial results, the Company's non-GAAP adjusted loss for the three months ended June 30, 2025 was approximately $9.9 million or $(0.10) per common share.

· Lucid had cash and cash equivalents of $31.1 million as of June 30, 2025, compared to $22.4 million as of December 31, 2024. During the quarter ended June 30, 2025, the Company completed a Confidentially Marketed Public Offering resulting in net proceeds of approximately $16.1 million.

Lucid Non-GAAP Measures

· To supplement our unaudited financial results presented in accordance with U.S. generally accepted accounting principles (GAAP), management provides certain non-GAAP financial measures of the Company's financial results. These non-GAAP financial measures include net loss before interest, taxes, depreciation, and amortization (EBITDA), and non-GAAP adjusted loss, which further adjusts EBITDA for stock-based compensation expense and other non-cash income and expenses, if any. The foregoing non-GAAP financial measures of EBITDA and non-GAAP adjusted loss are not recognized terms under U.S. GAAP.

· Non-GAAP financial measures are presented with the intent of providing greater transparency to the information used by us in our financial performance analysis and operational decision-making. We believe these non-GAAP financial measures provide meaningful information to assist investors, shareholders, and other readers of our unaudited financial statements in making comparisons to our historical financial results and analyzing the underlying performance of our results of operations. These non-GAAP financial measures are not intended to be, and should not be, a substitute for, considered superior to, considered separately from, or as an alternative to, the most directly comparable GAAP financial measures.

· Non-GAAP financial measures are provided to enhance readers' overall understanding of our current financial results and to provide further information for comparative purposes. Management believes the non-GAAP financial measures provide useful information to management and investors by isolating certain expenses, gains, and losses that may not be indicative of our core operating results and business outlook. Specifically, the non-GAAP financial measures include non-GAAP adjusted loss, and its presentation is intended to help the reader understand the effect of the loss on the issuance or modification of convertible securities, the periodic change in fair value of convertible securities, the loss on debt extinguishment, and the corresponding accounting for non-cash charges on financial performance. In addition, management believes non-GAAP financial measures enhance the comparability of results against prior periods.

· A reconciliation to the most directly comparable GAAP measure of all non-GAAP financial measures included in this press release for the three and six months ended June 30, 2025, and 2024 are as follows:

Source: Lucid Diagnostics Provides Business Update and Reports Second Quarter 2025 Financial Results

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back