Original from: Abbott

Abbott (NYSE: ABT) today announced financial results for the second quarter ended June 30, 2025.

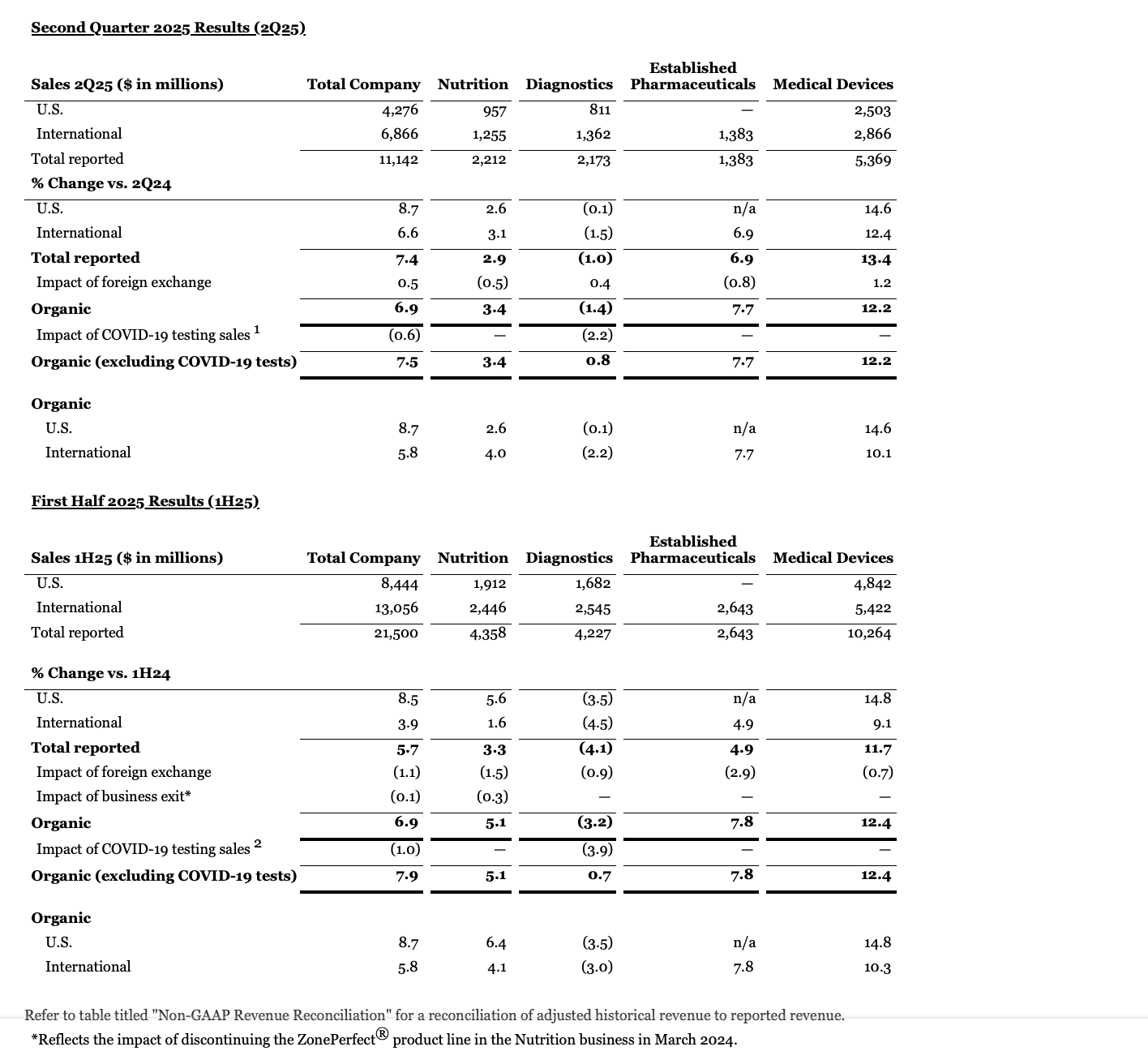

· Second-quarter sales increased 7.4 percent on a reported basis, 6.9 percent on an organic basis, or 7.5 percent when excluding COVID-19 testing-related sales1.

· Second-quarter GAAP diluted EPS of $1.01 and adjusted diluted EPS of $1.26, which excludes specified items and reflects double-digit growth compared to the prior year.

· First-half sales increased 5.7 percent on a reported basis, 6.9 percent on an organic basis, or 7.9 percent when excluding COVID-19 testing-related sales2.

· Abbott projects full-year 2025 organic sales growth, excluding COVID-19 testing-related sales, to be 7.5% to 8.0%, or 6.0% to 7.0% when including COVID-19 testing-related sales.

· Abbott projects full-year 2025 adjusted diluted EPS of $5.10 to $5.20, which reflects double-digit growth at the midpoint.

· In April, Abbott completed enrollment ahead of schedule in its FlexPulse U.S. IDE trial, which is designed to evaluate the TactiFlex™ Duo Pulsed Field Ablation (PFA) System for treating patients with heart rhythm disorders such as atrial fibrillation (AFib).

· In April, Abbott announced late-breaking data from the AVEIR™ Conduction System Pacing (CSP) clinical feasibility study. This study was the world's first assessment of a leadless pacemaker delivering conduction pacing, which produces pacing that closely mimics the heart's natural electrical rhythm and represents a new treatment option for people with irregular heart rhythms.

· In May, Abbott announced U.S. Food and Drug Administration (FDA) approval of the company's Tendyne™ transcatheter mitral valve replacement (TMVR) system, a first-of-its-kind device to help treat people with mitral valve disease.

· Abbott has initiated plans to develop a new cardiovascular device manufacturing facility in the state of Georgia to be completed by 2028.

"Halfway through the year, we delivered high single-digit organic sales growth, double-digit EPS growth, significantly expanded our margin profiles, and continued to advance key programs through our new product pipeline," said Robert B. Ford, chairman and chief executive officer, Abbott. "We see this momentum carrying into 2026."

SECOND-QUARTER BUSINESS OVERVIEW

Management believes that measuring sales growth rates on an organic basis, which excludes the impact of foreign exchange and the impact of discontinuing the ZonePerfect® product line in the Nutrition business, is an appropriate way for investors to best understand the core underlying performance of the business. Management further believes that measuring sales growth rates on an organic basis excluding COVID-19 tests is an appropriate way for investors to best understand the underlying performance of the company as the demand for COVID-19 tests has significantly declined following the transition from a pandemic to endemic phase.

Note: In order to compute results excluding the impact of exchange rates, current year U.S. dollar sales are multiplied or divided, as appropriate, by the current year average foreign exchange rates and then those amounts are multiplied or divided, as appropriate, by the prior year average foreign exchange rates.

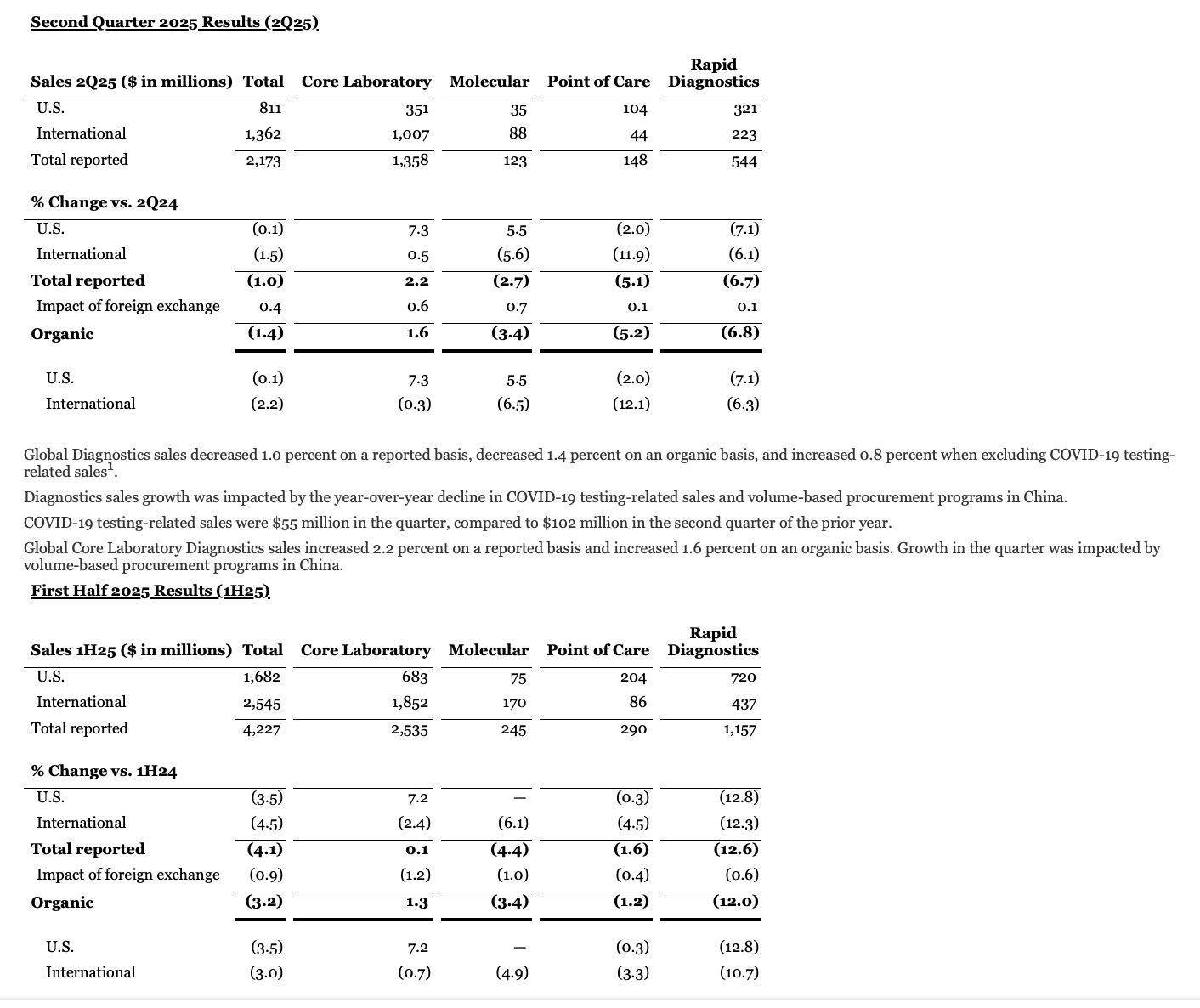

Diagnostics

ABBOTT'S FINANCIAL GUIDANCE

Abbott projects full-year 2025 organic sales growth, excluding COVID-19 testing related sales, to be 7.5% to 8.0%, or 6.0% to 7.0% when including COVID-19 testing-related sales.

Abbott projects full-year 2025 adjusted operating margin to be approximately 23.5% of sales.

Abbott projects full-year 2025 adjusted diluted earnings per share of $5.10 to $5.20 and third-quarter 2025 adjusted diluted earnings per share of $1.28 to $1.32.

Abbott has not provided the related GAAP financial measures on a forward-looking basis for these forward-looking non-GAAP financial measures because the company is unable to predict with reasonable certainty and without unreasonable effort the timing and impact of certain items such as restructuring and cost reduction initiatives, charges for intangible asset impairments, acquisition-related expenses, and foreign exchange, which could significantly impact Abbott's results in accordance with GAAP.

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back