Original from: Prof. Haibo Song (Chairman of CAIVD, Founder of CACLP)

With over 40 years of development, China's in vitro diagnostic (IVD) industry has made significant strides, presenting a comprehensive range of products that boast improving quality and surging export demands. The internationalization of IVD products, especially concerning human health, emerges as a pivotal strategy of companies for manufacturing, development, and future growth.

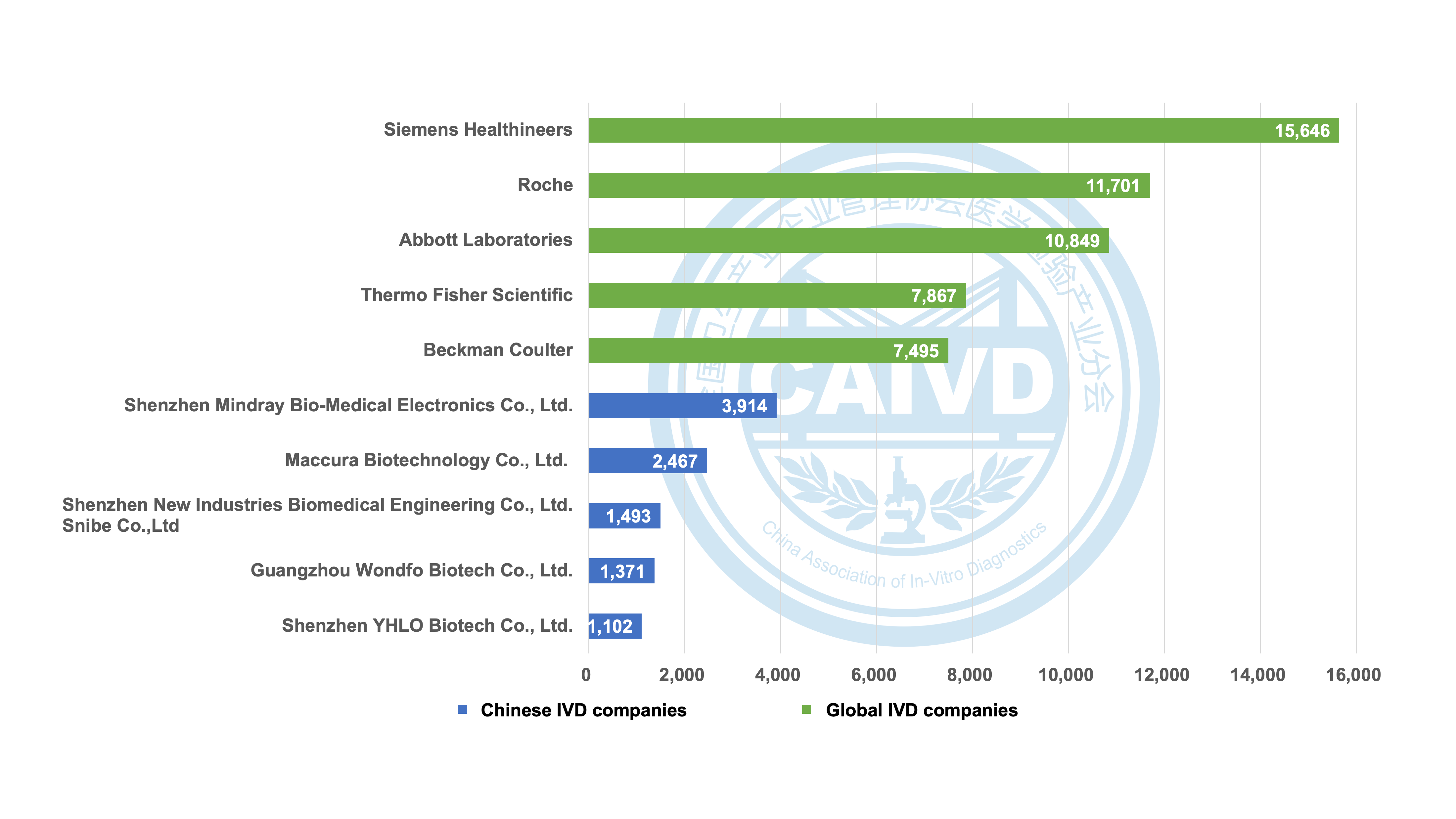

Chinese IVD firms, which are relatively nascent, have established industrial scale and production capacity within about 10 years. Amidst mounting competition in China's market and the trend of continuous internationalization, an increasingly vital aspect is the international layout. This approach is essential for bridging the gap between China's and the global market, in terms of cutting-edge technology, robust industrial chain construction, enhanced product quality, operational capabilities, and advanced management concepts and mechanisms. When assessing product registrations on the official websites of relevant countries worldwide, we find that there is still significant ground to cover as evidenced by the difference between Chinese IVD companies and internationally acclaimed counterparts.

In recent years, several IVD companies have achieved remarkable internationalization milestones. For instance, Mindray boasts an impressive 3,914 registration certificates worldwide, of which 3,158 are from overseas markets. Similarly, Maccura has secured 2,467 registration certificates worldwide, including 1,962 from overseas, while Snibe holds 1,493 global registration certificates, with 1,127 obtained from overseas.

These registered products encompass various risk levels and classifications, showcasing the progress in international market expansion. However, it is essential to acknowledge that despite this success, there still exists a substantial disparity between the number of registration certificates held by these companies and that of global industry leaders.

Figure 1 Statistics on the number of global registrations of selected companies (compared with international companies)

Siemens Healthineers boasts a global presence with 15,646 registration certificates, including 995 registrations in China. Similarly, Roche holds an impressive count of 11,701 registration certificates worldwide, with 667 of these obtained in China. Additionally, Abbott Laboratories holds 10,849 registration certificates, and 528 of them are specifically registered in China.

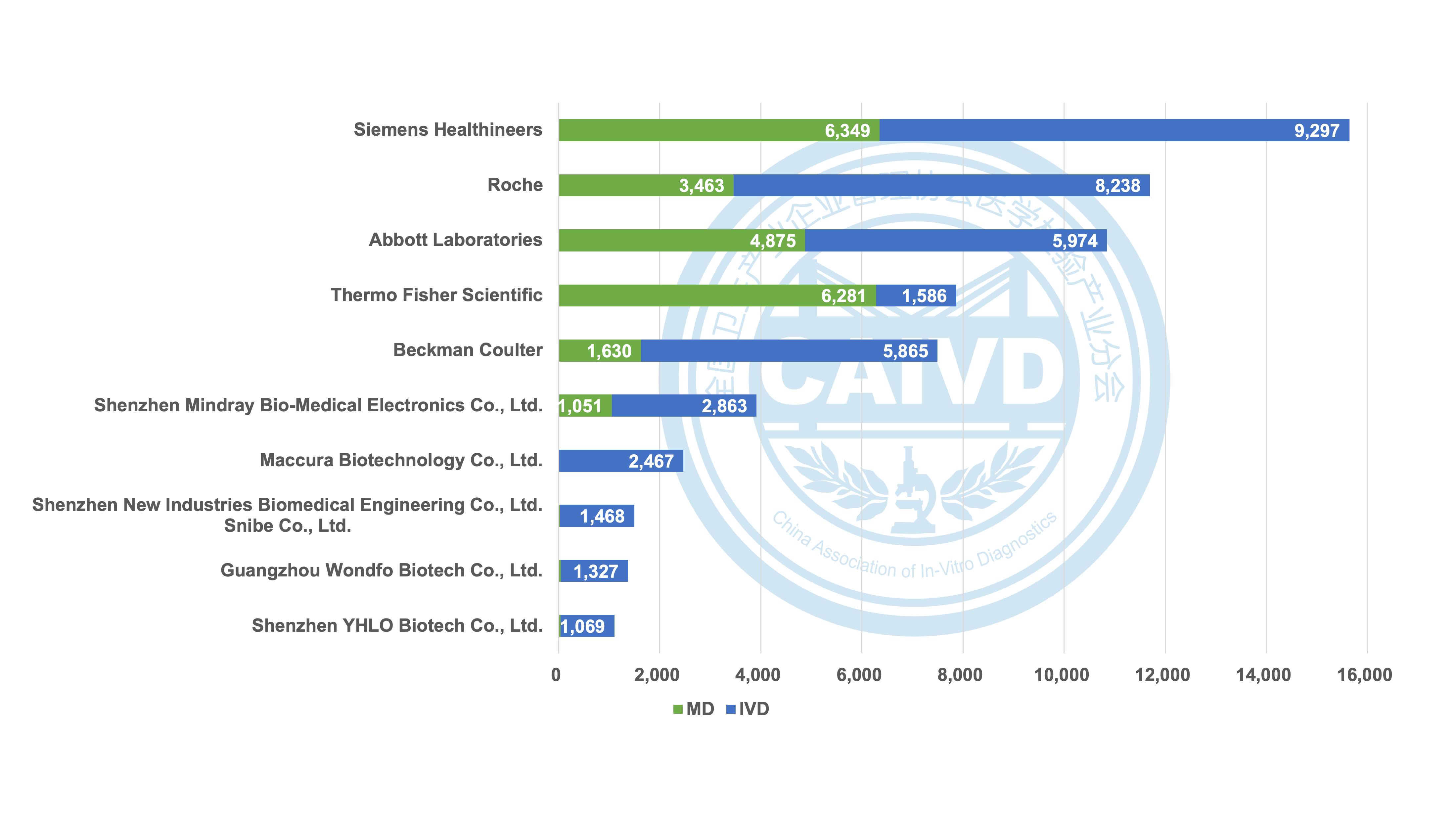

Figure 2 Statistics on the number of global registrations of selected companies (IVD & MD)

Regarding the distribution of IVD (in vitro diagnostic) products and MD (medical devices), global medical device companies and IVD manufacturers boast well-established registration records, resulting in a more evenly spread market presence. Conversely, the majority of Chinese companies, with the exception of a few such as Mindray, primarily concentrate on IVD products.

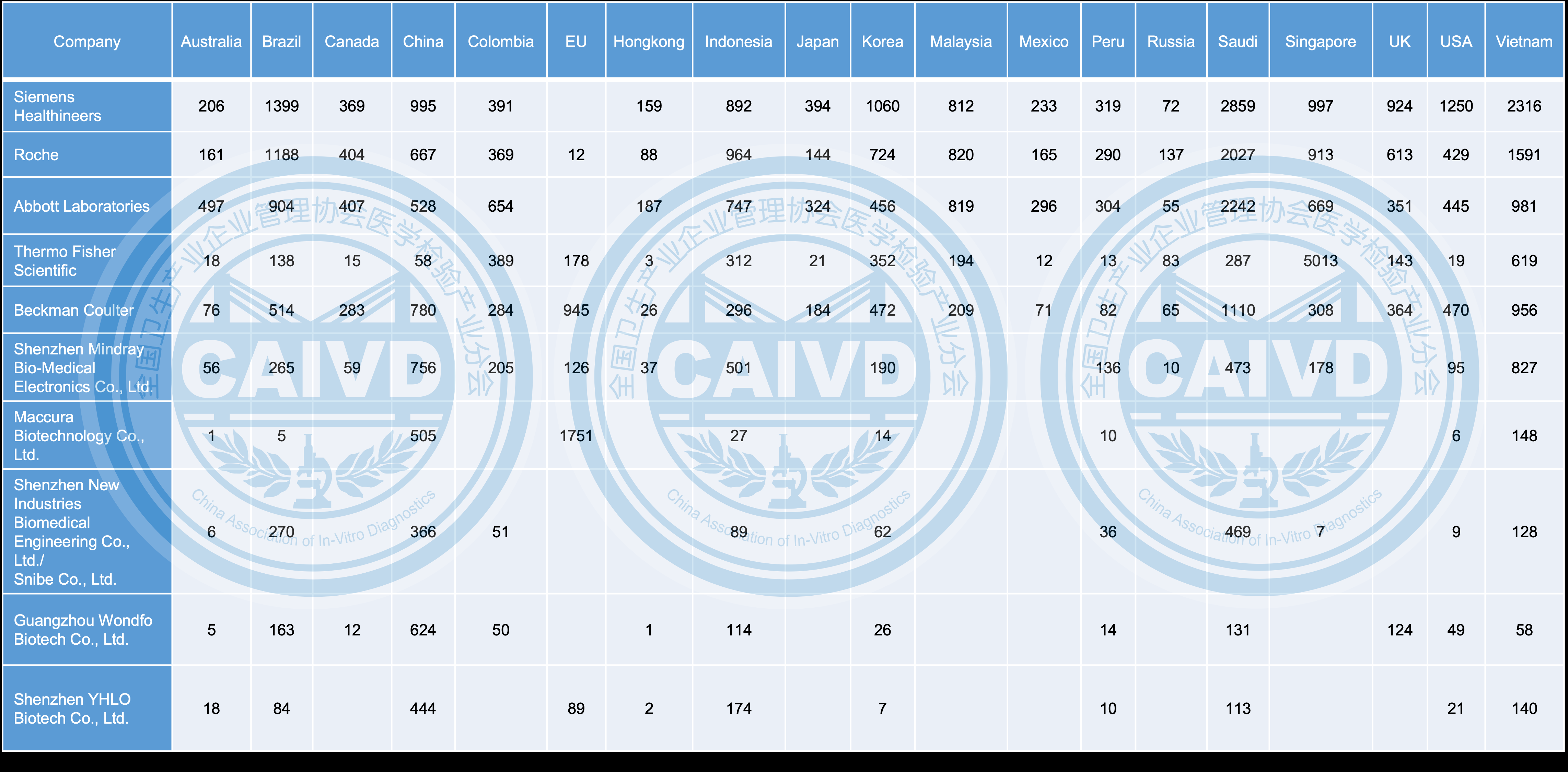

From an international perspective, Chinese firms have strategically established their presence not only in popular markets like the United States, the European Union, Australia, Japan, and South Korea but also in emerging markets such as Vietnam, Indonesia, Singapore in Southeast Asia, Saudi Arabia in the Middle East, and Brazil, Colombia, and India in South America. These rapidly growing markets have garnered increasing attention from Chinese companies, leading to their thoughtful expansion and investment.

Figure 3 Overseas distribution destinations of selected companies (compared with international companies)

In terms of international product registration, there remains a notable gap between Chinese companies compared to global ones. For instance, Beckman Coulter and Thermo Fisher Scientific have successfully registered their products in 19 countries and regions, whereas the leading Chinese company, Mindray, has managed to register products in 15 countries and regions.

It is imperative for local companies to bolster their global distribution, which should primarily focus on increasing product registrations worldwide while ensuring impeccable product quality and compliance with the regulations of export destinations. This increase will serve as the foundation for penetrating the international market, enabling Chinese IVD companies to move beyond the in China for China approach and truly embrace in China for the world, so as to achieve significant global impact and reach.

Engaged in insightful discussions with Ms. Zhu MENG, the esteemed founder of PureID, who specializes in international medical device registrations, we discovered that a positive trend is highlighted when analyzing the global market and registration data by the GRIP system. As Chinese companies have been enhancing their product quality and reputation, the demands for gaining international recognition and expanding into the global market are steadily rising. It is believed that China's IVD industry will continue to evolve and to achieve greater momentum in the process of internationalization.

China's increasing openness, the implementation of the Healthy China initiative, and the rapid industry growth, coupled with the global demands for preventing and controlling the COVID-19 pandemic since 2020, all led to the accelerated internationalization of China's IVD industry. Mindray acquired HyTest and notable companies such as Wondfo. Gongdong, Orient Gene, Andon, Zybio, Fosun, YHLO, Snibe, and Autobio successfully ventured into the international market. PerkinElmer has rebranded its life science and IVD business under the new brand Revvity, focusing on R&D and production of IVD products with centers and bases in China. In the first three quarters of 2022, Snibe installed 1,141 chemiluminescent instruments in China and sold 3,637 units abroad. Zybio’s hematological cytometer and mass spectrometry instruments also recorded significant oversea sales. Previously export-oriented companies like Orient Gene have strengthened their marketing in China. Global companies like Roche, Abbott Laboratories, Beckman Coulter, Siemens Healthineers, and Hitachi have accelerated localization through establishing R&D centers and production bases in China and forging strategic partnerships with Chinese companies. For small and medium enterprises, embracing internationalization is crucial in supporting future rapid development.

Undoubtedly, it is a prudent decision for Chinese IVD companies to explore opportunities overseas, expanding global business in the context of healthcare reform, centralized procurement, and fierce competition. The mature and stable pricing systems in international markets, along with their vast scale and demands, offer support for enterprises’ development.

Internationalization stands as a key direction for Chinese IVD companies to sustain strong development in the future, making it an indispensable approach for securing the long-term viability of the industry. By capitalizing on the opportunity and elevating efforts in product R&D, production, and quality, IVD companies can supply products with competitive manufacturing capabilities, unique advantages, and favorable pricing to global markets. As a Chinese IVD company, this endeavor will undoubtedly contribute significantly to the advancement of human health on a global scale (Data sourced from official statistics).

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back