Original from: Myriad Genetic

Myriad Genetics, Inc. (NASDAQ: MYGN), a leader in molecular diagnostic testing and precision medicine, today announced financial results for its second quarter ended June 30, 2025 and updated its financial guidance on business performance for the full-year 2025.

"We delivered solid second-quarter results, driven by continued strength in hereditary cancer testing in oncology, improving momentum in hereditary cancer testing for unaffected individuals, and favorable pricing trends supported by mix and our ongoing efforts to expand payer coverage. Our disciplined approach to expense management contributed to our improved profitability while we continued to invest in strategic drivers to enable long-term growth," said Sam Raha, President and CEO, of Myriad Genetics. “We have made significant progress on updating our strategy and intend to accelerate growth by focusing future investments on more comprehensively serving screening and diagnostic applications across the Cancer Care Continuum while being disciplined on driving targeted profitable growth from our other businesses. To help support our next chapter, we have partnered with OrbiMed in a non-dilutive financing, providing meaningful support for Myriad Genetics' long-term goals. As we begin to implement our updated strategy, while continuing to strengthen our organization and execution, I’m confident in our ability to achieve sustained value creation going forward.”

Strategy Update

In the second quarter of 2025, Myriad Genetics initiated a review of its long-range growth strategy. While the updated strategy, which is designed to drive accelerated growth and profitability by focusing on the Cancer Care Continuum, will be completed over the next several months, the company has identified three strategic pillars:

Financial and Operational Highlights

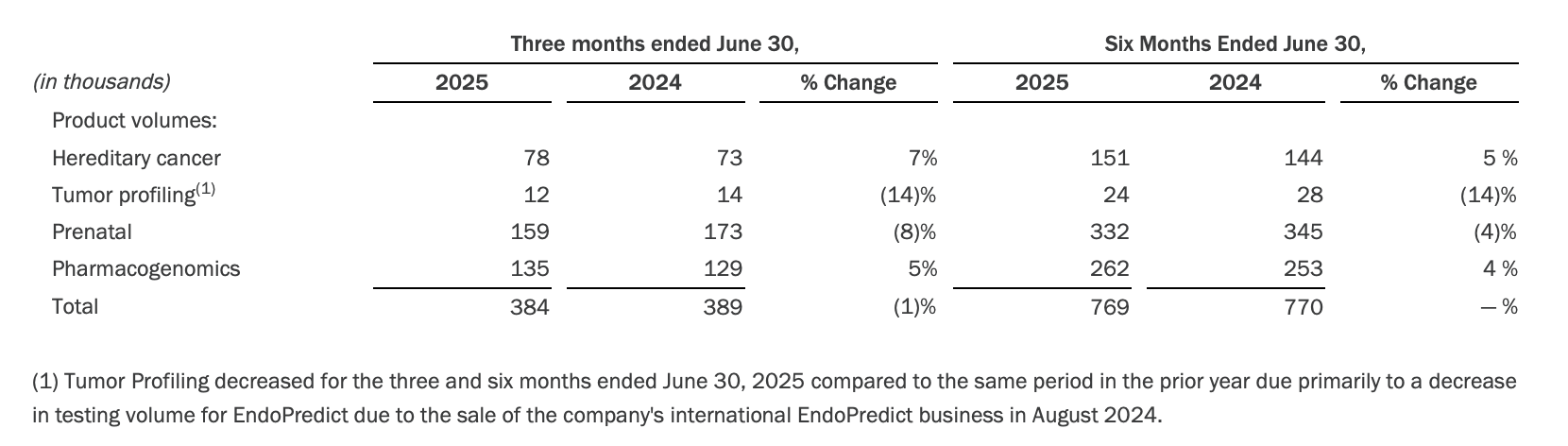

· Test volumes of 384,000 in the second quarter of 2025 decreased 1% year-over-year.

· The following table summarizes year-over-year testing volume changes in the company's core product categories:

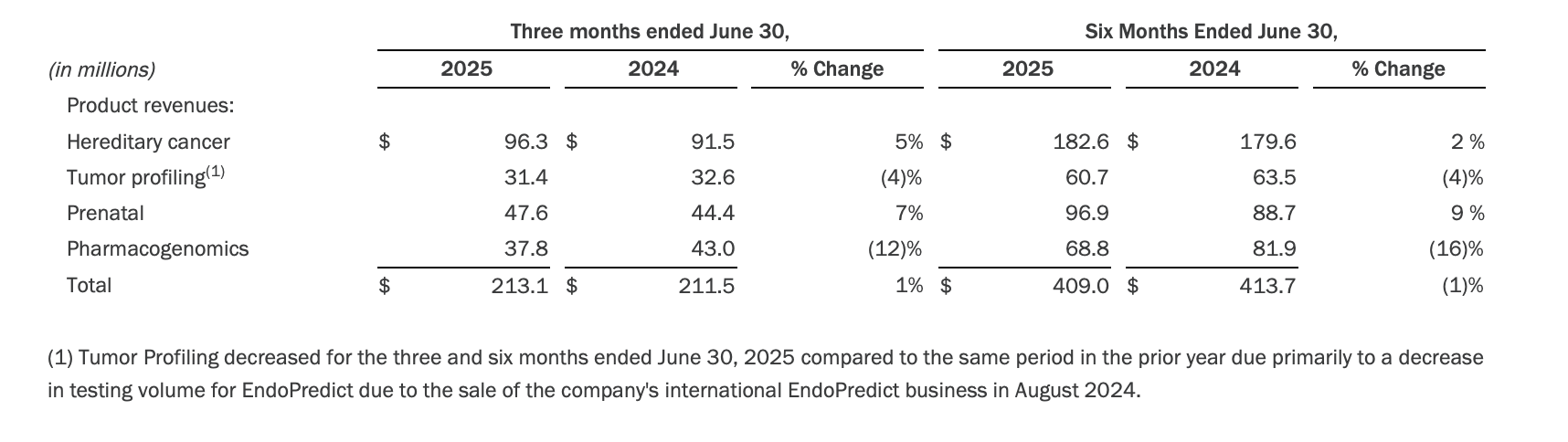

· The following table summarizes year-over-year revenue changes in the company's core product categories:

· Operating expenses in the second quarter of 2025 were $481.0 million, increasing $297.4 million year-over-year, reflecting the impairment of goodwill and intangible assets of $316.7 million. Adjusted operating expenses in the second quarter of 2025 increased $3.0 million year-over-year to $143.8 million, reflecting the company's commitment to disciplined cost management while maintaining investments in key strategic areas, such as research and development.

· Operating loss in the second quarter of 2025 was $329.2 million; adjusted operating income in the second quarter of 2025 was $8.6 million.

Cash Flow and Liquidity

Second quarter 2025 cash flow used in operations was $13.6 million; adjusted cash flow used in operations in the second quarter of 2025 was $10.2 million. Capital expenditures and capitalization of internal use software costs were $6.9 million in the second quarter 2025.

As of the end of the second quarter of 2025, the company had cash and cash equivalents of $74.4 million. On July 31, 2025, the company entered into a new $200 million term loan facility that replaced its current asset-based credit facility.

Business Performance and Highlights

Oncology

The Oncology business delivered revenue of $85.5 million in the second quarter of 2025.

· Second quarter 2025 hereditary cancer testing revenue and volume in Oncology grew 9% and 10% year-over-year, respectively, as MyRisk with RiskScore testing volume in oncology grew 14% year-over-year.

· New clinical data regarding the use of Myriad's ultra-sensitive Precise MRD test in the MONSTAR-SCREEN 3 study, a collaboration with the National Cancer Center Hospital East (NCCHE) in Japan, was presented at the American Society of Clinical Oncology (ASCO) annual meeting in May 2025. This study showed 100% sensitivity at baseline with 60% of patients testing positive one month after surgery had tumor fractions only detectable via ultra-sensitive MRD.

· Second quarter 2025 Prolaris test revenue grew 4% year-over-year as Myriad Genetics continues to educate clinicians on the critical role the company's portfolio of offerings can play across the patient’s prostate cancer journey. The company continues to make progress and intends to commercially launch its first AI-driven prostate cancer test, in partnership with PATHOMIQ, in the first quarter of 2026.

Women’s Health

The Women’s Health business delivered revenue of $89.8 million in the second quarter of 2025.

· Second quarter 2025 hereditary cancer testing revenue and volume for the unaffected population increased 1% and 3% year-over-year, respectively, as the company continues to develop and deploy its electronic medical records (EMR) solutions and further expand its breast cancer risk assessment programs across its current and new provider base.

· Prenatal testing revenue in the second quarter of 2025 grew 7% year-over-year, reflecting ongoing expansion of payer coverage, particularly for Foresight Expanded Carrier Screen. Volume over that same period decreased 8% year-over-year due to friction from new order management system implementation.

· Commenced early access to our FirstGene™ Multiple Prenatal Screen within the 5,000 patient, multi-site CONNECTOR study.

Pharmacogenomics

GeneSight test revenue was $37.8 million in the second quarter of 2025. GeneSight test volume in the second quarter of 2025 grew 5% year-over-year, reflecting a modest improvement over the year-over-year growth reported in the first quarter of 2025.

· Second quarter revenue continues to reflect the impact of UnitedHealthcare's decision to discontinue coverage of multi-gene panel pharmacogenetic testing, including GeneSight, effective in the first quarter of 2025.

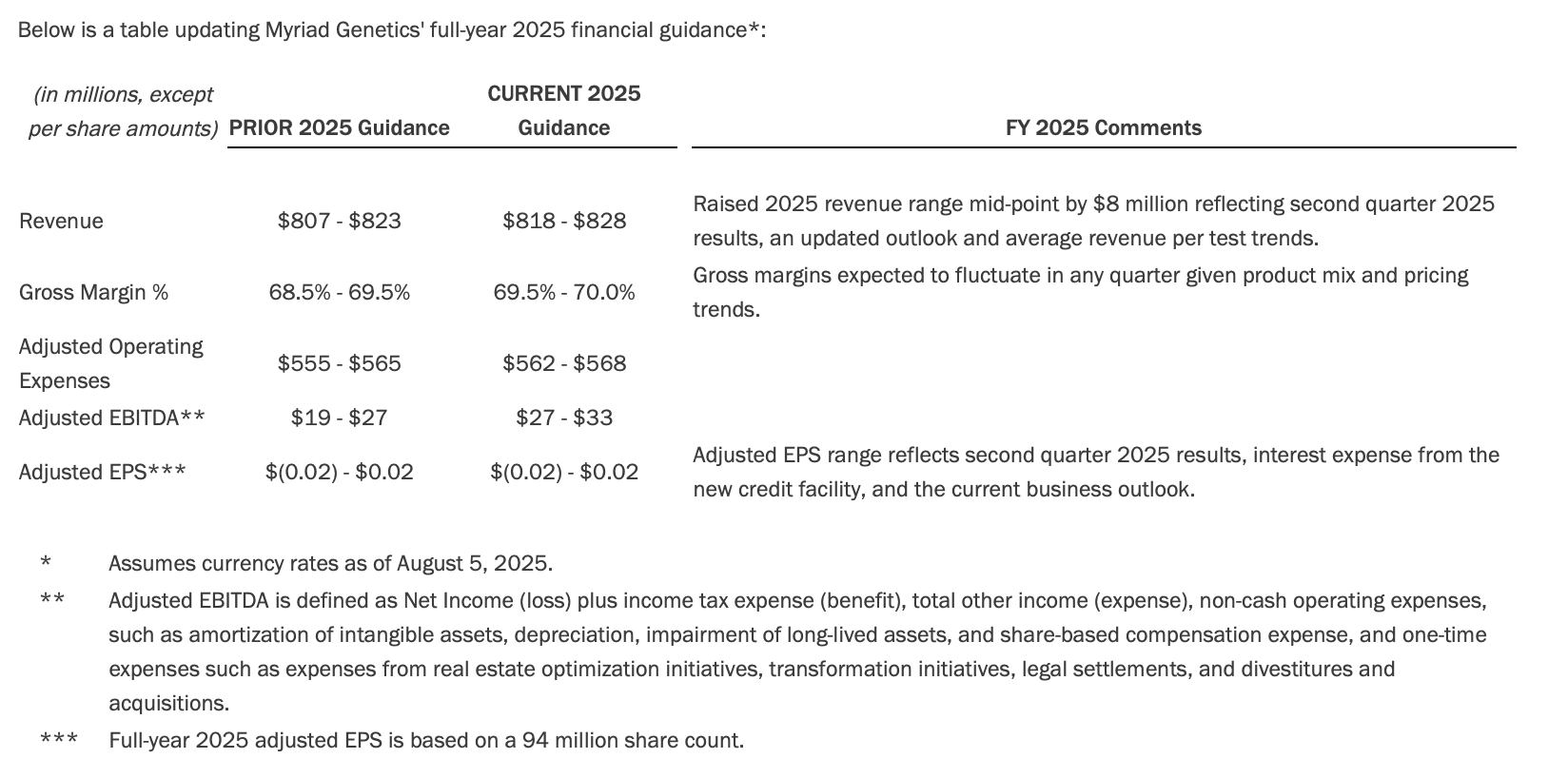

Financial Guidance

Myriad Genetics does not provide forward-looking guidance in accordance with accounting principles generally accepted in the United States (GAAP) for the measures on which it provides forward-looking non-GAAP guidance as the company is unable to provide a quantitative reconciliation of forward-looking non-GAAP measures to the most directly comparable forward-looking GAAP measure, without unreasonable effort, because of the inherent difficulty in accurately forecasting the occurrence and financial impact of the various adjusting items necessary for such reconciliations that have not yet occurred, are dependent on various factors, are out of the company's control, or cannot be reasonably predicted. Such adjustments include, but are not limited to, real estate optimization and transformation initiatives, certain litigation charges and loss contingencies, costs related to acquisitions/divestitures and the related amortization, impairment and related charges, depreciation, equity compensation, tax benefits, and other adjustments. For example, stock-based compensation may fluctuate based on the timing of employee stock transactions and unpredictable fluctuations in the company's stock price. Any associated estimate of these items and its impact on GAAP performance could vary materially.

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back