Original from: BD

BD (Becton, Dickinson and Company) (NYSE: BDX), a leading global medical technology company, today announced results for its fiscal 2025 third quarter, which ended June 30, 2025.

"We increased our organic growth trajectory in Q3 while delivering strong margin and EPS growth fueled by BD Excellence, enabling us to raise our EPS guidance and reaffirm organic revenue growth expectations for the full year," said Tom Polen, chairman, CEO and president of BD. "We also announced in July an agreement to combine BD's Biosciences and Diagnostic Solutions business with Waters Corporation, which is expected to create an innovative life science and diagnostic leader focused on high-volume testing with a leading financial outlook. We are focused on closing the transaction and realizing the meaningful value-creation opportunity for BD shareholders through capturing the upside of synergies and growth within the combined company as well as maximizing the value of New BD. Looking ahead for the remainder of the fiscal year, we remain focused on further accelerating sequential growth as we position New BD for its next chapter of long-term success."

Recent Business Highlights

· The company announced a definitive agreement to combine BD's Biosciences & Diagnostic Solutions business with Waters Corporation, in a transaction which is expected to create an innovative life science and diagnostics leader with an industry-leading financial outlook focused on regulated, high-volume testing.

· BD Medical:

- The Medication Delivery Solutions business unit announced:

- Plans to invest $35 million in Nebraska facility to support new BD® PosiFlush™ Prefilled Flush Syringe production lines, product innovation and operational efficiencies, enabling BD to produce hundreds of millions of additional units annually to meet growing demand from U.S. hospitals and health systems.

- BD Vascular Access Management has been recognized with the Infusion Nurses Society Seal of Approval.

- The Pharmaceutical Systems business unit announced the first pharma-sponsored combination product clinical trial using the BD Libertas™ Wearable Injector for subcutaneous delivery of complex biologics.

· BD Interventional:

- The Peripheral Intervention business unit announced plans to initiate a patient data registry, known as "XTRACT," for the Rotarex™ Atherectomy System to measure real-world outcomes for patients with peripheral artery disease.

· BD Life Sciences:

- The Diagnostic Solutions business unit announced:

- Submission of FDA application for at-home BD Onclarity™ HPV Assay that includes a state-of-the-art fiber swab for self-collection, is fully automated on the BD COR™ Systemand reports more high-risk HPV strains than any other test on the market today.

- Receipt of FDA 510(k) clearance for the BD Veritor™ System rapid point-of-care COVID-19 test.

- The Biosciences business unit announced the global commercial launch of the BD FACSDiscover™ A8 Cell Analyzer, the world's first cell analyzer which features breakthrough spectral and real-time cell imaging technologies, bringing leading-edge capabilities to a wider range of scientists across academia and biopharma.

· BD issued its Fiscal Year 2024 Together We Advance Corporate Sustainability Report and announced it has achieved its Scope 1 and 2 science-based greenhouse gas (GHG) emissions reduction target for FY 2024, as well as mid-point reduction targets for water consumption and energy use.

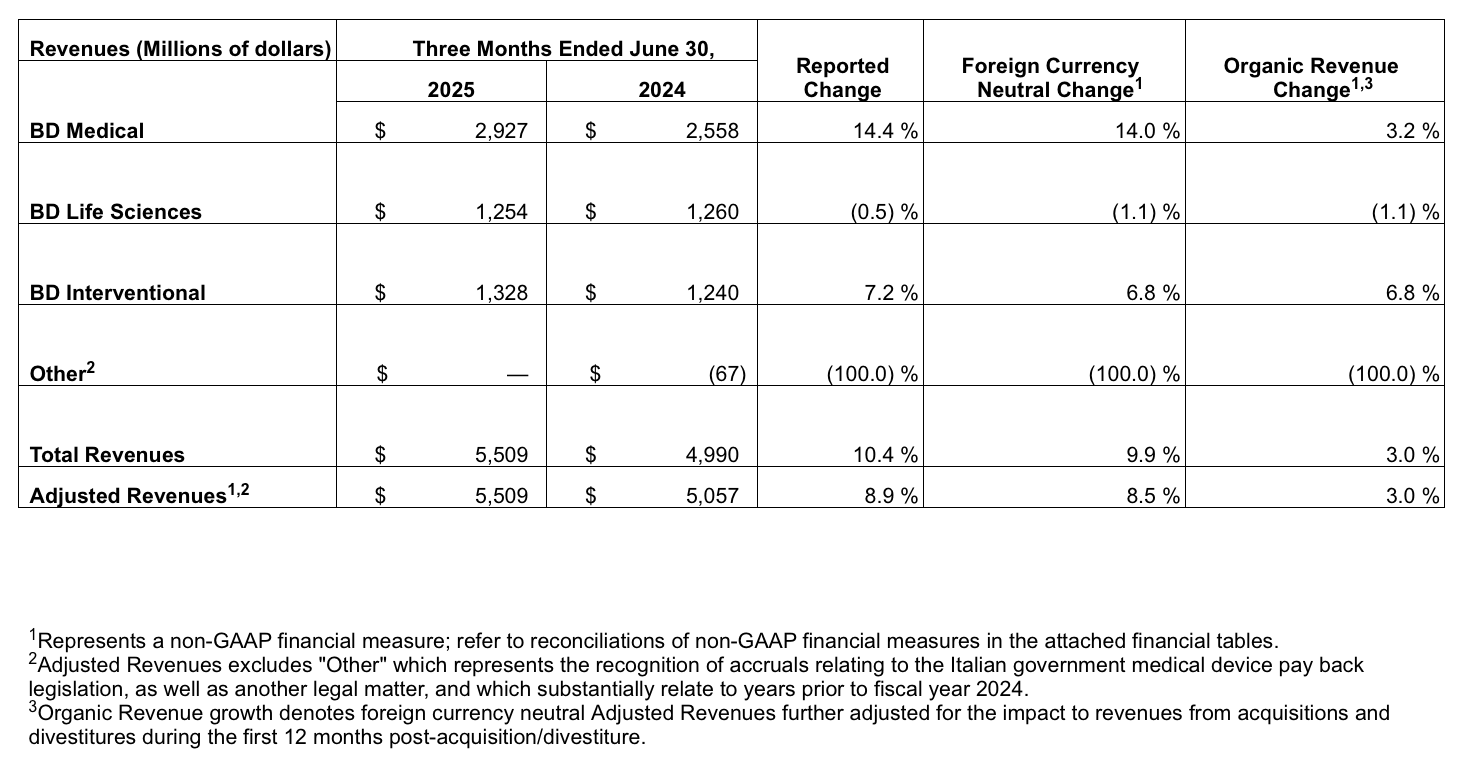

Third Quarter Fiscal 2025 Operating Results

Geographic Results

Segment Results

The BD Medical segment includes the Medication Delivery Solutions (MDS), Medication Management Solutions (MMS) and Pharmaceutical Systems (PS) business units, and the Advanced Patient Monitoring (APM) business unit. BD Medical performance reflects the revenue contribution from APM, which was formed upon the closing of the acquisition of Critical Care from Edwards Lifesciences on September 3, 2024. BD Medical organic revenue growth reflects mid single-digit growth in MMS and PS and low single-digit growth in MDS.

· MDS performance reflects increased volumes driven by share gains in Vascular Access Management and hypodermic products in the U.S., partially offset by an impact from the IV fluid shortage and volume-based procurement in China.

· MMS performance reflects continued strength in Infusion Systems, and solid growth in Dispensing Solutions and Pharmacy Automation.

· PS performance reflects sustained double-digit growth in Biologics, partially offset by lower market demand for non-biologic products.

The BD Life Sciences segment includes the Specimen Management (SM), Diagnostic Solutions (DS) and Biosciences (BDB) business units. BD Life Sciences performance reflects declines in DS and BDB that were partially offset by low single-digit growth in SM.

· SM performance reflects growth in the BD Vacutainer™ portfolio, partially offset by performance in China.

· DS performance reflects declines in point of care testing and BD BACTEC™ blood culture, partially offset by continued double-digit growth in BD MAX™ IVD. BD BACTEC™ utilization improved sequentially, exiting the quarter at over 80% of historical levels.

· BDB performance was driven by continued market dynamics impacting instrument demand, partially offset by strong early traction from the FACSDiscover™ A8 and continued strength in reagents and service excluding a discontinued legacy platform.

The BD Interventional segment includes the Surgery (SURG), Peripheral Intervention (PI), and Urology & Critical Care (UCC) business units. BD Interventional performance reflects double-digit growth in UCC and mid single-digit growth in SURG and PI.

· SURG performance reflects high single-digit growth in Advanced Tissue Regeneration, Infection Prevention and Biosurgery, partially offset by legacy U.S. hernia.

· PI performance reflects strong growth in Peripheral Vascular Disease driven by strength in the Rotarex™ Atherectomy System.

· UCC performance reflects strong double-digit growth in the PureWick™ franchise with continued adoption of the Male and Female portfolios.

Assumptions and Outlook for Full Year Fiscal 2025

The company raised its full-year adjusted EPS guidance to $14.30 to $14.45, reflecting an $0.18 increase to 9.4% growth at the midpoint. This reflects strong Q3 operating performance and incremental investments in selling and marketing in Q4. The company reaffirmed its organic revenue growth guidance of 3.0% to 3.5%.

For the full fiscal year, the company now estimates the impact of translational foreign currency to be an increase of approximately $10 million to revenue year over year and about neutral to adjusted EPS.

BD's outlook for fiscal 2025 reflects numerous assumptions about many factors that could affect its business, based on the information management has reviewed as of this date. Management will discuss its outlook and several of its assumptions on its third fiscal quarter earnings call.

The company's expected adjusted diluted EPS for fiscal 2025 excludes potential charges or gains that may be recorded during the fiscal year, such as, among other things, the non-cash amortization of intangible assets, acquisition-related charges, separation-related costs, and certain tax matters. BD does not attempt to provide reconciliations of forward-looking adjusted diluted non-GAAP EPS guidance to the comparable GAAP measure because the impact and timing of these potential charges or gains are inherently uncertain and difficult to predict and are unavailable without unreasonable efforts. In addition, the company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items could have a material impact on GAAP measures of BD's financial performance. We also present our estimated adjusted revenue growth and organic revenue growth for our 2025 fiscal year after adjusting for the illustrative impact of foreign currency translation. BD believes that this adjustment allows investors to better evaluate BD's anticipated underlying earnings performance for our 2025 fiscal year in relation to our underlying 2024 fiscal year performance.

Source: BD Reports Third Quarter Fiscal 2025 Financial Results

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back