Original from: QIAGEN

QIAGEN N.V. (NYSE: QGEN; Frankfurt Prime Standard: QIA) today announced financial results for the fourth quarter and full-year 2024.

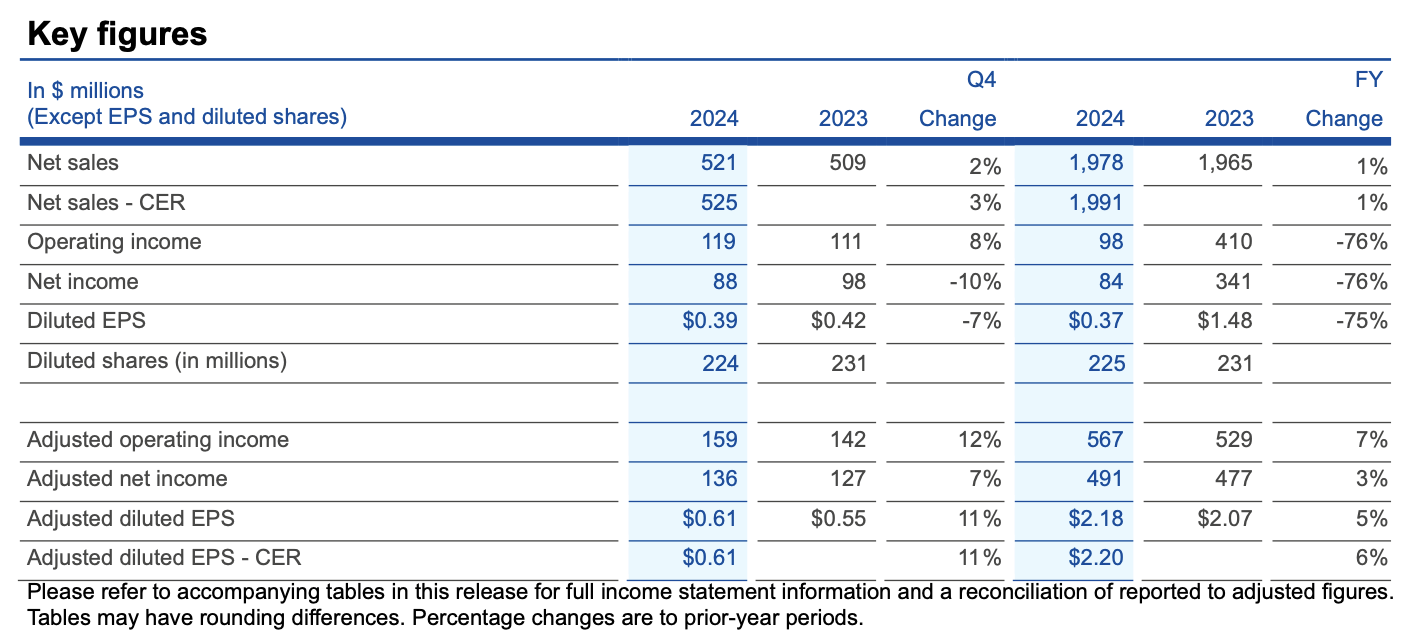

Net sales for Q4 2024 increased 2% to $521 million compared to Q4 2023, while sales at constant exchange rates (CER) of $525 million rose 3% and were above the outlook for at least $520 million CER and core sales (excluding discontinued products such as NeuMoDx and Dialunox) rose 4% CER. The adjusted operating income margin improved by 2.6 percentage points to 30.6%, driven by efficiency gains and benefits from the NeuMoDx decision, enabling reinvestments into targeted growth initiatives. Adjusted diluted earnings per share (EPS) were $0.61, and CER results of $0.61 were above the outlook for at least $0.60 CER.

QIAGEN expects the solid growth pace in H2 2024 to continue in 2025. Net sales are expected to rise about 4% CER (and core sales growth of about 5% CER). Adjusted diluted EPS is expected to be at least $2.28 CER, driven by a goal to improve the adjusted operating income margin by at least 150 basis points to above 30% while absorbing lower non-operating income contributions than in 2024.

“Our teams at QIAGEN concluded 2024 with a solid performance in the fourth quarter, exceeding our outlook for net sales and profitability. These results underscore the resilience of our portfolio, with over 85% of sales coming from highly recurring revenues, and our focus on delivering solid profitable growth in an ongoing challenging environment,” said Thierry Bernard, CEO of QIAGEN.

“Our solid sales growth in the second half of 2024 mirrors our plans for further strong growth in 2025 as we reconfirm our 2028 targets. QIAstat-Dx exceeded expectations with four FDA clearances for our syndromic testing system in 2024 and one already in 2025, coupled with over 660 placements in2024 that was ahead of our target. QuantiFERON delivered 11% CER growth for 2024, with significant opportunities for further expansion since only 40% of the global latent TB testing market has so far been converted from the outdated skin test. QIAcuity also delivered solid growth despite challenging instrument purchase trends as we expanded digital PCR into clinical use in 2024 while expanding our presence with academia, pharma and other customers.”

“We are pleased with our 2024 results that featured strong free cash flow combined with solid sales growth and a significant increase in the outlook for adjusted EPS during the year thanks to operational profitability improvements. Our confidence in QIAGEN's future is reflected in the return of about $300 million to shareholders in January through a synthetic share repurchase. We remain well-positioned to execute on our 2028 commitments for solid profitable growth, supported by our differentiated portfolio and disciplined capital allocation that seeks to strengthen our business while increasing returns to shareholders,” said Roland Sackers, CFO of QIAGEN.

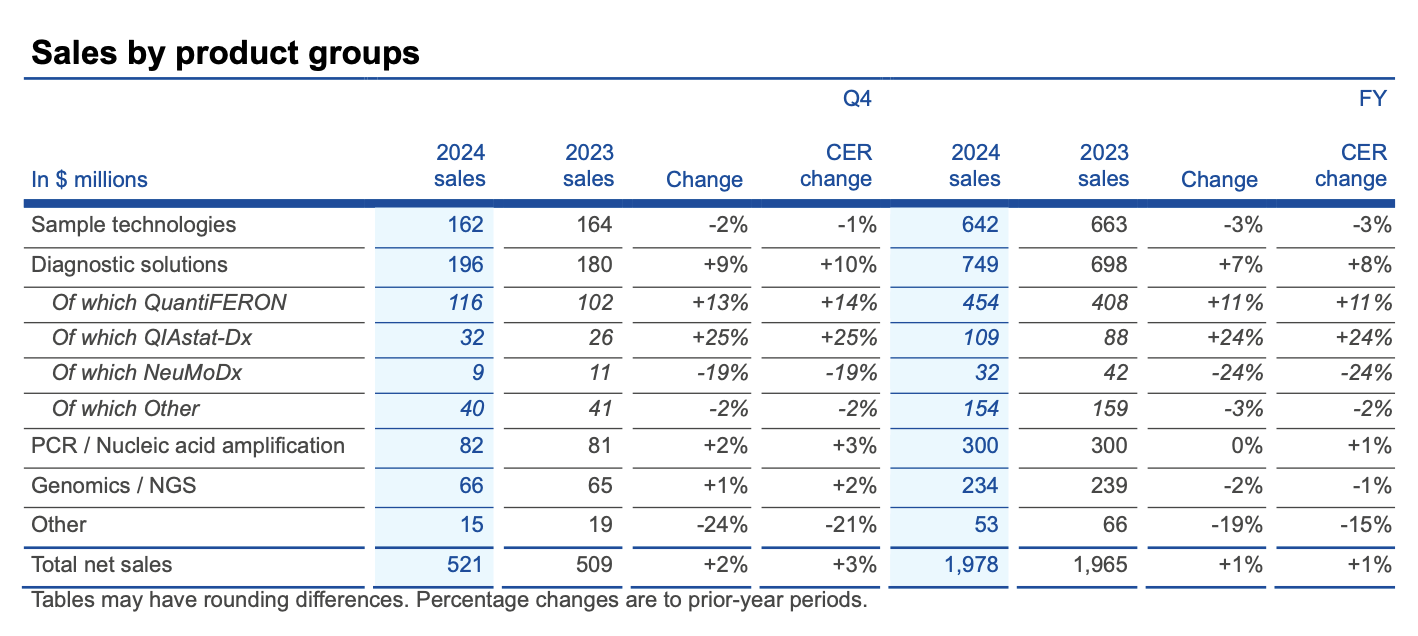

• Sales: Q4 2024 results showed 3% CER sales growth compared to Q4 2023, and 4% CER core growth (excluding sales from discontinued products). Diagnostic solutions led the product groups with 10% CER growth (+12% core growth) and driven by QuantiFERON (+14% CER) and QIAstat-Dx (+25% CER). PCR and Genomics product groups also delivered higher sales, while Sample technologies saw a modest decline. Consumables and related revenues grew 4% CER over Q4 2023, while instrument sales declined 6% CER due to ongoing cautious customer capital spending trends throughout 2024. For FY 2024, net sales increased 1% CER - and core sales rose 2% CER - supported by improving growth trends in H2 2024 compared to results in H2 2023.

• Operating income: In Q4 2024, operating income rose 8% to $119 million, and included $21 million of pre-tax charges related to ongoing efficiency measures including the discontinuation of NeuMoDx. Adjusted operating income increased 12% to $159 million, with the adjusted operating income margin improving to 30.6% of sales from 28.0% in Q4 2023. This was driven by efficiency

gains across QIAGEN that enabled reinvestments into growth initiatives, along with benefits of the NeuMoDx decision. In terms of components, the adjusted gross margin rose to 67.1% of sales from 65.7% in Q4 2023 due to various factors such as higher production capacity utilization. R&D investments were 9.3% of sales in Q4 2024, up slightly from 9.0% in Q4 2023, and aligned with the FY 2024 target. Sales and marketing expenses decreased to 21.8% of sales from 23.1% in Q4 2023, while General and administrative expenses declined to 5.3% of sales from 5.6% in Q4 2023. For FY 2024, the adjusted operating income margin was 28.7% of sales, an increase of 1.8 percentage points from 26.9% in 2023.

• EPS: Diluted EPS was $0.39 per share in Q4 2024 compared to $0.42 in Q4 2023. Adjusted diluted EPS for Q4 2024 were $0.61 ($0.61 CER), and above the outlook for at least $0.60 CER. The adjusted tax rate was 19% in Q4 2024, and consistent with the quarterly estimate. For FY 2024, adjusted diluted EPS increased to $2.18 ($2.20 CER) from $2.07 in 2023, reflecting the significant improvements in adjusted operating income during the course of the year compared to the initial outlook for at least $2.10 CER.

• Sample technologies: Higher sales of consumables for use on QIAGEN instruments, as well as for Human ID / Forensics applications, led the performance in Q4 2024. The EZ2 Connect system reached a milestone of over 1,000 cumulative placements since launch. Overall sales were slightly lower than in Q4 2023 due to a modest sales decline in manual kits and challenging instrument sales trends that continued throughout 2024.

• Diagnostic solutions: Q4 2024 sales grew 10% CER, and rose 12% CER excluding NeuMoDx, led by double-digit CER gains in consumables sales that absorbed a decline in instrument sales over Q4 2023. The QuantiFERON test for latent tuberculosis (TB) detection delivered 14% CER sales growth on solid demand in all regions as only about 40% of the global latent TB testing market has been converted to blood-based testing. QIAstat-Dx delivered 25% CER sales growth on double-digit gains in both consumables and instruments. The syndromic testing system surpassed the 2024 goal with over 660 new placements and reached more than 4,600 cumulative placements since launch. The NeuMoDx system remains on track for discontinuation in mid-2025.

• PCR / Nucleic acid amplification: Q4 2024 sales rose 3% CER over the year-ago period driven by the QIAcuity digital PCR system, which saw double-digit CER growth in consumables and reached over 2,700 cumulative placements since launch despite ongoing challenging instrument purchasing trends. Sales of other PCR consumables grew at a low single-digit CER rate compared to Q4 2023.

• Genomics / Next-generation sequencing (NGS): Sales for Q4 2024 grew 2% CER over Q4 2023, supported by growth in universal consumables used on third-party NGS systems. QIAGEN Digital Insights (QDI) sales increased at a single-digit CER rate, driven by growth in the clinical portfolio that more than offset a modest decline in the discovery portfolio. QDI's results in 2024 were adversely impacted by the ongoing transition to SaaS (software-as-a-service) subscription models, particularly in the pharmaceutical sector, from longer-term licensing agreements.

Outlook

For 2025, QIAGEN has initiated an outlook that anticipates a continuation of the solid growth trends from H2 2024. Net sales are expected to rise about 4% CER (about 5% CER in the core business). Adjusted diluted EPS is expected to be at least $2.28 CER, supported by a goal to improve the adjusted operating income margin by at least 150 basis points to above 30% while absorbing lower non-operating income contributions and a higher adjusted tax rate than in 2024. For Q1 2025, net sales are expected to rise about 3% CER (about 4% CER in the core business) from $459 million in Q1 2024. Adjusted diluted EPS are expected to be at least $0.50 CER compared to $0.46 in Q1 2024.

Based on exchange rates as of February 1, 2025, for FY 2025, currency movements against the U.S. dollar are expected to have a negative impact on net sales of about two percentage points and a negative impact of about $0.02-$0.03 per share on adjusted EPS results. For Q1 2025, currency movements against the U.S. dollar are expected to have a negative impact on net sales of about two percentage points and a negative impact of about $0.01 per share on adjusted EPS results.

Source: QIAGEN delivers solid Q4 2024 growth ahead of outlook

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back