Original from: Diasorin

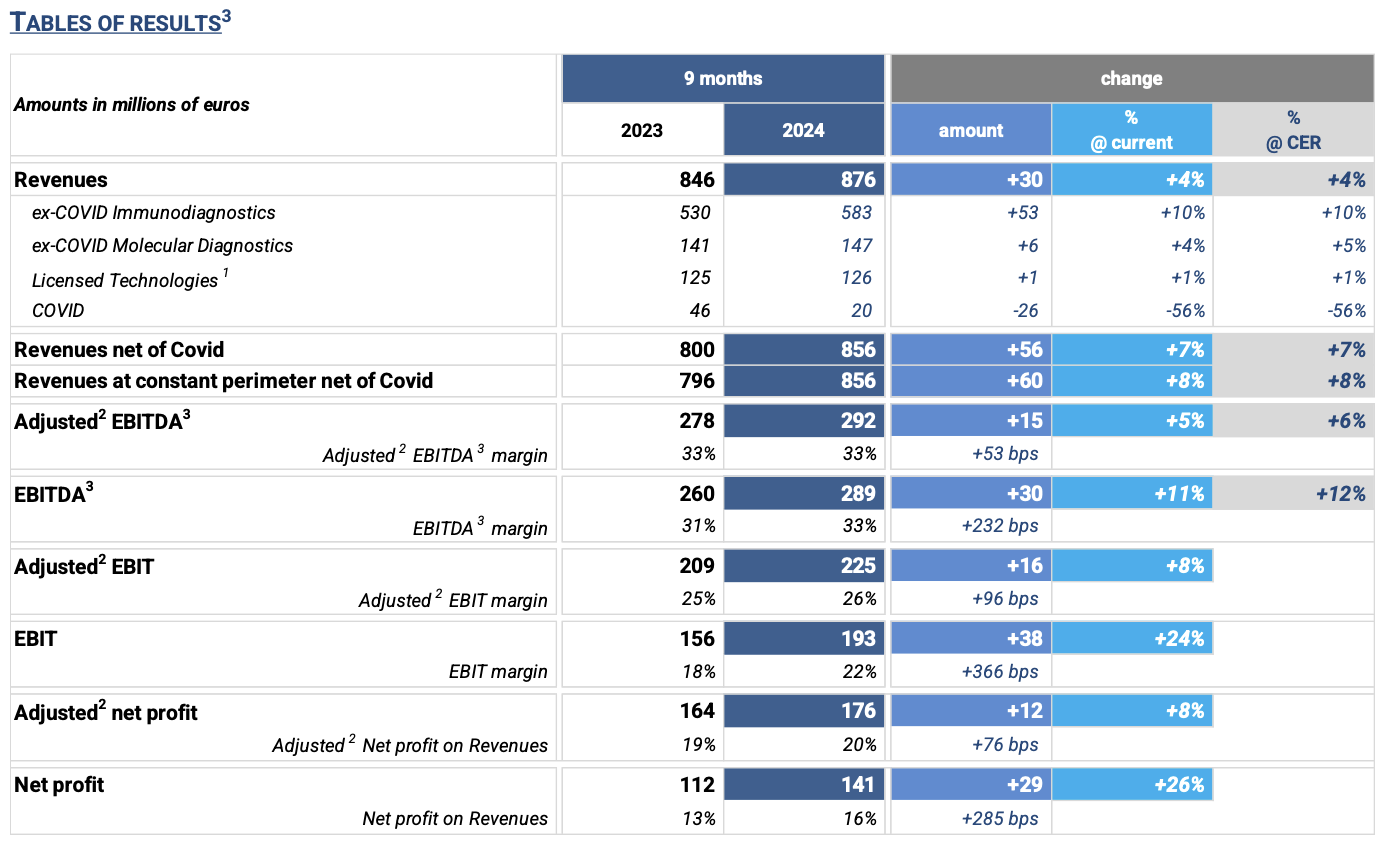

· Revenues: € 876 million, +4% “as reported” compared to September 2023; +7% ex covid (+8% at constant perimeter of Consolidation1)

· Adjusted2 ebitda3: € 292 million, +6% at constant exchange rates compared to 9m 2023, equal to 33% of revenues

· FY 2024 guidance raised, with ex-covid revenues expected to grow at approx. +7% (covid revenues equal to approx. € 30 million) and adjusted2 ebitda3 margin4 equal to approx. 33%

The Board of Directors of Diasorin S.p.A. (FTSE MIB: DIA), examined and approved the Group’s Consolidated Financial Statements at September 30, 2024.

COMMENTS ON ECONOMIC RESULTS

REVENUES: € 876 million, +4% (at current and constant exchange rates). Excluding the COVID business, 9M 2024 revenues grew +7% at current and constant exchange rates compared to the same period of the previous year, a result in line with the high range of the FY 2024 guidance.

In Q3 2024, revenue growth net of COVID business was equal to +9% (+10% at constant exchange rates). The increase is attributable to the excellent performance of the three business lines.

In particular:

· Ex-COVID Immunodiagnostics: € 583 million, an increase of € 53 million, equal to +10% (at current and constant exchange rates) vs. 9M 2023, driven by the excellent performance of CLIA specialty tests.

In Q3 2024, business grew by +10% (+11% at constant exchange rates), mainly due to the excellent performance of the U.S. market driven by the Hospital Strategy and the broad offer of specialties, and the European market due to increased volumes in most countries in the region.

· Ex-COVID Molecular Diagnostics: € 147 million, +4% (+5% at constant exchange rates) vs. 9M 2023.

In Q3 2024, business grew by +5% (+6% at constant exchange rates), mainly due to the “legacy Diasorin molecular business”, the respiratory business, and the resilience of the multiplexing business on the Verigene I platform.

· Licensed Technologies: € 126 million, at constant perimeter of consolidation1 revenues would be equal to +1% at current and constant exchange rates vs. 9M 2023. The performance including the business of Flow Cytometry, divested in February 2023, is equal to -2% compared to the previous year. In Q3 2024, business grew +7% (+8% at constant exchange rates) as a combination of two transitory phenomena: a particularly negative figure in Q3 2023 due to destocking carried out last year by some major customers, and the shipment of some consumable orders earlier that expected. More generally, the Life Science segment continues to experience softness, particularly in instrument sales, offset by the good performance of customers operating in the Diagnostic segment.

· COVID: € 20 million, in line with expectations and equal to -56% (at current and constant exchange rates) vs. 9M 2023.

The following is the revenue performance by geographic area, net of the contribution of COVID products:

· North America Direct: € 420 million, +10% (+11% at constant exchange rates).

At constant perimeter of consolidation1, the increase is equal to +11% at current and constant exchange rates, mostly driven by the excellent performance of the immunodiagnostic business, as a result of the success of the U.S. Hospital Strategy, of the broad offering of specialties, as well as the great performance of the molecular diagnostic business.

In Q3 2024, the immunodiagnostic business confirmed an excellent performance (+18% at constant exchange rates) and Licensed Technologies business registered an important contribution (+17% at constant exchange rates) compared to the same period of the previous year, for the aforementioned reasons.

· Europe Direct: € 302 million, +8% at current and constant exchange rates.

The growth was driven by the positive performance of the Immunodiagnostic business, with a focus on the specialty tests that characterize Diasorin's offerings.

In Q3 2024, the immunodiagnostic business continues to be the main growth driver (+10% at constant exchange rates) supported by an increase of volumes in the majority of countries in this geographical area, also following certain localized infectious disease outbreaks, as well as the continued success of the broad specialty menu.

· Rest of the World: € 134 million, -4% (-3% at constant exchange rates).

The performance of this geographic area was negatively impacted by the performance of markets in which Diasorin operates through distributors (Iran in particular) and the Chinese market, which continues to be a complex environment for foreign providers. It is confirmed, on the other hand, the positive trend of markets where the Group operates directly, especially Australia and Brazil.

In Q3 2024, this geographical area registered a performance in line with the same period of the previous year, reporting a slight increase, equal to +1% at constant exchange rates.

ADJUSTED2 GROSS PROFIT: € 578 million (equal to 66% of revenues), an increase of € 25 million, +5% compared to 9M 2023, confirming the improved margin profile despite the expected reduction in COVID sales.

ADJUSTED2 EBITDA3: € 292 million (equal to 33% of revenues), an increase of € 15 million, equal to +5% (+6% at constant exchange rates) compared to 9M 2023. In Q3 2024, growth shows a further acceleration (+7%) compared to the same period in 2023, with EBITDA margin at 33%.

ADJUSTED2 EBIT: € 225 million (equal to 26% of revenues), an increase of € 16 million (+8%) vs. 9M 2023. Q3 2024 is the contributor to the growth, which results in +11% over the same period of 2023.

NET FINANCIAL EXPENSES € 12 million (€ 11 million in 2023); slightly up from 9M 2023.

INCOME TAXES: € 41 million (with a tax rate of 23%, in line with what registered in 9M 2023).

ADJUSTED2 NET PROFIT: € 176 million (equal to 20% of revenues), an increase of € 12 million (+8%) vs. 9M 2023.

COMMENT ON FINANCIAL RESULTS

CONSOLIDATED NET FINANCIAL DEBT: -€ 686 million (-€ 776 million at December 31, 2023).

The change, equal to -€ 91 million, is mainly related to the operating cash flow generation in 9M 2024.

FREE CASH FLOW5: € 164 million at September 30, 2024 (€ 160 million at September 30, 2023).

The change is partially attributable to increased investment activity in new technologies and upcoming products.

BUSINESS HIGHLIGHTS

IMMUNODIAGNOSTICS:

- Announcement of submission of LIAISON® LymeDetect® to the U.S. Food and Drug Administration (FDA);

- LIAISON® Streptococcus pneumoniae Ag launched in all countries accepting the CE Mark.

MOLECULAR DIAGNOSTICS:

- Divestment of ARIES molecular diagnostics business line and consolidation of the related customer base on LIAISON® MDX platform;

- FDA 510(k) clearance of LIAISON PLEX®, the new multiplexing platform and the respiratory panel LIAISON PLEX® Respiratory Flex Assay;

- FDA 510(k) clearance of LIAISON PLEX® Yeast Blood Culture Assay, the second multiplexing panel for the LIAISON PLEX® platform;

- FDA 510(k) clearance of NxTAG® Respiratory Pathogen Panel (RPP) v2 for which Diasorin collaborated with the Biomedical Advanced Research and Development Authority (BARDA), part of the Administration for Strategic Preparedness and Response within the U.S. Department of Health and Human Services;

- FDA “de-novo” grant of Direct Simplexa® C. auris kit for LIAISON® MDX platform, indicated for diagnosis on patients with suspected colonization from Candida auris;

- FDA 510(k) submission of the LIAISON PLEX® Gram-Negative Blood Culture Assay, the second Blood Culture panel on the LIAISON PLEX®

FY 2024 GUIDANCE REVISED UPWARDS AT 2023 CONSTANT EXCHANGE RATES

- EX-COVID REVENUES: approx. +7% (COVID revenues equal to approx. € 30 million)

- ADJUSTED2 EBITDA3 MARGIN4: approx. 33%

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back