Original from: Roche

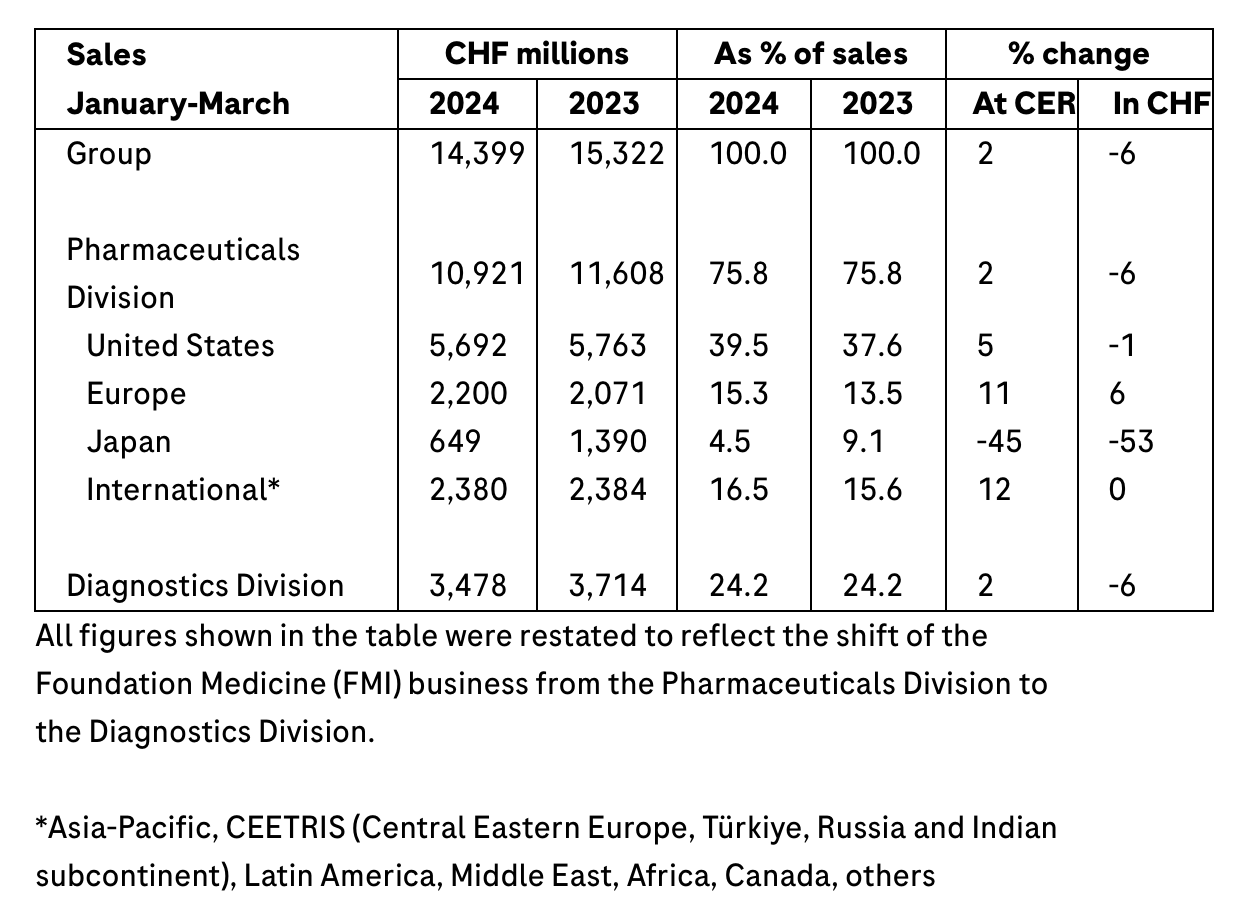

· Group sales grew by 2%1 at constant exchange rates (CER) (-6% in CHF), driven by the strong growth of newer medicines and diagnostics. Excluding COVID-19-related products, sales increased by 7%. Going forward, there will be no further material impact of COVID-19 sales decline

· Due to the appreciation of the Swiss franc against most currencies, sales were 6% lower when reported in CHF

· Pharmaceuticals Division base business2 grew by 7%, driven by strong sales of medicines to treat severe diseases, such as Vabysmo (eye diseases), Phesgo (breast cancer), Ocrevus (multiple sclerosis), Polivy (blood cancer) and Hemlibra (haemophilia A). Divisional sales growth was 2%, reflecting the impact of the expected decline in sales of the COVID-19 medicine Ronapreve

· Diagnostics Division base business2 grew by 8%, supported by growth across all regions because of demand for immunodiagnostic products, clinical chemistry tests and advanced staining solutions. As this growth was partially offset by the lower demand for COVID-19 tests, divisional sales grew by 2%

· Highlights in the first quarter:

- US approvals of Xolair (food allergies) and Alecensa (early-stage lung cancer)

- Positive phase III data for Xolair (food allergies), Columvi (blood cancer) and Ocrevus subcutaneous injection (multiple sclerosis); positive phase II results for zilebesiran (hypertension in people with high cardiovascular risk)

- New positive long-term data for Vabysmo (retinal vein occlusion, a severe eye disease)

- US approval for the first molecular test to screen for malaria in blood donors

- US Breakthrough Device Designation for blood test to support earlier Alzheimer’s disease diagnosis

· Outlook for 2024 confirmed

Roche CEO Thomas Schinecker: “We had a strong start into the year, with both our divisions reporting high single digit growth in their base business – excluding COVID-19 sales. After this quarter, the COVID-19-related impact on sales is largely behind us. The appreciation of the Swiss franc versus most currencies impacted sales reported in Swiss francs compared to the same period last year. The uptake of our eye medicine Vabysmo continues its momentum. We are pleased about the US approval of Xolair as the first and only medicine for multiple food allergies. Further, we recently received the US approval for Alecensa in early-stage lung cancer. With an unprecedented 76% reduction in the risk of disease recurrence or death versus chemotherapy, Alecensa significantly improves upon the standard of care for this specific form of lung cancer.

We are confident of growing our Group sales in the mid single digit range this year (at constant exchange rates) and therefore we confirm our outlook for 2024.”

Outlook for 2024 confirmed

Roche expects an increase in Group sales in the mid single digit range (CER). Core earnings per share are targeted to develop broadly in line with sales growth (CER), excluding the impact from the resolution of tax disputes in 2023. Roche expects to further increase its dividend in Swiss francs.

Group sales

In the first three months of 2024, Group sales increased by 2% CER (-6% in CHF) to CHF 14.4 billion as strong demand for newer medicines as well as diagnostics products including immunodiagnostics, clinical chemistry tests and advanced staining solutions more than offset the anticipated decline in COVID-19-related sales and the impact of biosimilar/generic erosion.

After this quarter, the impact of the drop in COVID-19-related sales is largely over and there will be no further material impact on Group sales.

Excluding COVID-19-related products, sales increased by 7%.

The appreciation of the Swiss franc against most currencies had a significant adverse impact on the sales reported in Swiss francs compared to constant exchange rates.

Pharmaceuticals Division base business grew by 7%, while divisional sales increased by 2% to CHF 10.9 billion as the strong global demand for newer medicines to treat severe diseases was partially offset by the expected decline in COVID-19 Ronapreve sales.

The eye medicine Vabysmo was the biggest growth driver, with Phesgo (breast cancer), Ocrevus (multiple sclerosis), Polivy (blood cancer) and Hemlibra (haemophilia A) being other significant contributors.

Together, these medicines generated sales of CHF 4.2 billion, an increase of CHF 0.9 billion (at CER) from the first quarter of 2023.

The negative impact of biosimilar/generic erosion on our medicines Lucentis (eye diseases, US commercialisation rights only), MabThera/Rituxan (blood cancer), Herceptin (breast and stomach cancer), Avastin (various types of cancer), Esbriet (lung disease) and Actemra/RoActemra (arthritis, COVID-19) totalled CHF 0.4 billion (at CER), in line with expectations.

In the United States, sales increased by 5%, driven by strong demand for newer medicines such as Vabysmo, Polivy, Ocrevus, Phesgo and Evrysdi (spinal muscular atrophy) as well as for Xolair (allergies).

This contrasted with lower sales of Lucentis, MabThera/Rituxan, Tecentriq (cancer immunotherapy), Esbriet, Avastin and Perjeta.

In Europe, sales grew by 11%, with Vabysmo, Phesgo, Hemlibra, Evrysdi and Ocrevus being the key drivers.

Sales in Japan were down by 45%, reflecting the base effect of the supply of Ronapreve to the government in the first quarter of 2023.

Sales in the International region increased by 12%, driven by strong growth in Hemlibra, Perjeta, Phesgo, Ocrevus, Tecentriq and Vabysmo. In China, sales grew by 11% due to high demand for Xofluza (influenza), Perjeta, Avastin, Polivy and Tecentriq.

The Diagnostics Division’s base business continued good growth (8%), boosted by demand for immunodiagnostic products, clinical chemistry tests and advanced staining solutions. This was partially offset by the expected sales decline of COVID-19-related products, leading to divisional sales growing at 2% to CHF 3.5 billion.

Immunodiagnostic products, which include cardiac, oncology and thyroid tests, were the main growth drivers (10%). Additional growth impetus came from clinical chemistry (8%), advanced staining techniques in oncology (12%) and companion diagnostics (47%).

As expected, the sales of COVID-19 tests further declined to CHF 0.1 billion in the first quarter of 2024 from CHF 0.3 billion in the corresponding period last year.

Sales growth was reported across regions, with Europe, Middle East and Africa (EMEA) growing by 2%, Asia-Pacific by 1% and Latin America by 14%. North America recorded a decline of 1%, reflecting the drop in demand for COVID-19-related tests.

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back