Original from: business wire

Bio-Rad Laboratories, Inc. (NYSE: BIO and BIOb), a global leader in life science research and clinical diagnostic products, today announced financial results for the second quarter ended June 30, 2023.

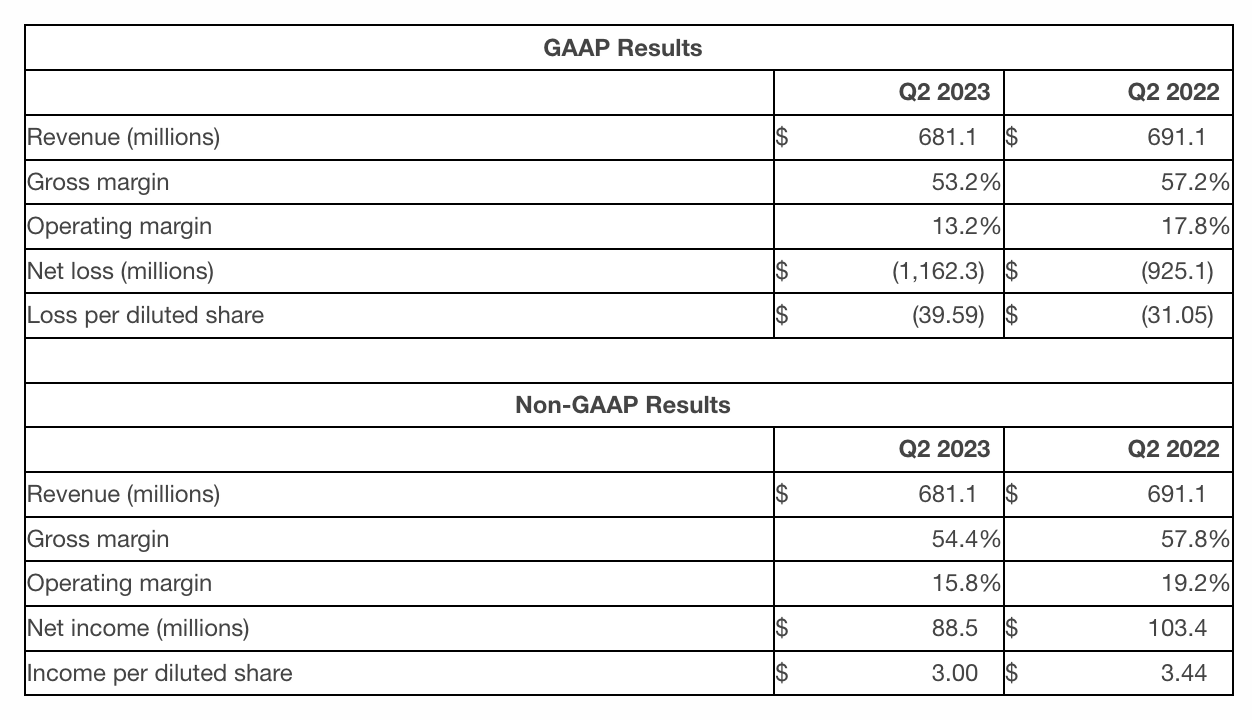

Second-quarter 2023 net sales were $681.1 million, a decrease of 1.4 percent compared to $691.1 million reported for the second quarter of 2022. On a currency-neutral basis, quarterly sales decreased 0.3 percent compared to the same period in 2022. COVID-related sales were approximately $0.4 million in the second quarter of 2023 versus approximately $33 million in the year ago period. Excluding COVID-related sales, revenue increased 4.6 percent on a currency-neutral basis.

Life Science segment net sales for the second quarter were $300.2 million, a decrease of 6.9 percent compared to the same period in 2022. On a currency-neutral basis, Life Science segment sales decreased by 5.8 percent compared to the same quarter in 2022. Excluding COVID-related sales, Life Science revenue grew 4.5 percent and was primarily driven by Droplet Digital PCR and qPCR products.

Clinical Diagnostics segment net sales for the second quarter were $380.1 million, an increase of 3.3 percent compared to the same period in 2022. On a currency-neutral basis, net sales increased 4.6 percent versus the same quarter last year. Excluding COVID-related sales, Clinical Diagnostics revenue increased 4.8 percent year over year, on a currency-neutral basis, driven by continued strong demand for diagnostic testing systems, as well as quality control products.

Second-quarter gross margin was 53.2 percent compared to 57.2 percent during the second quarter of 2022.

Income from operations during the second quarter of 2023 was $89.6 million versus $122.9 million during the same quarter last year.

Net loss for the second quarter of 2023 was $1,162.3 million, or $39.59 per share, on a diluted basis, versus a net loss of $925.1 million, or $31.05 per share, on a diluted basis, during the same period in 2022. Net loss amounts for the second quarter of 2023 and 2022 were primarily impacted by the recognition of changes in the fair market value of equity securities related to the holdings of the company’s investment in Sartorius AG.

The effective tax rate for the second quarter of 2023 was 22.5 percent, compared to 24.2 percent for the same period in 2022. The tax rates for both periods were driven by the large unrealized loss in equity securities.

“During the second quarter, we significantly reduced the backlog of customer orders in our Life Science business, and we remain on track to work down slightly elevated back orders in Clinical Diagnostics during the remainder of this year,” said Norman Schwartz, Bio-Rad’s President and Chief Executive Officer. “While weakness in the early-stage biotech market persists, we are now seeing softer demand from larger biopharma customers. As a result, we are lowering our full-year 2023 expectations. We believe these market dynamics to be transitory and remain confident in our long-term growth outlook.”

The non-GAAP financial measures discussed below exclude certain items detailed later in this press release under the heading “Use of Non-GAAP and Currency-Neutral Reporting.” A reconciliation between historical GAAP operating results and non-GAAP operating results is provided following the financial statements that are part of this press release.

Non-GAAP gross margin was 54.4 percent for the second quarter of 2023 compared to 57.8 percent during the second quarter of 2022.

Non-GAAP income from operations during the second quarter of 2023 was $107.9 million versus $132.5 million during the comparable prior-year period.

Non-GAAP net income for the second quarter of 2023 was $88.5 million, or $3.00 per share, on a diluted basis, compared to $103.4 million, or $3.44 per share, on a diluted basis, during the same period in 2022.

The non-GAAP effective tax rate for the second quarter of 2023 was 22.5 percent, compared to 19.1 percent for the same period in 2022. The higher rate in 2023 was driven by geographical mix of earnings.

Updated 2023 Financial Outlook

Bio-Rad is updating its financial outlook for full-year 2023. The company currently expects non-GAAP currency-neutral revenue growth of approximately 0.8 percent in 2023 compared to its previous estimate of 4.5 percent and an estimated non-GAAP operating margin of about 16.0 percent versus the company’s prior estimate of approximately 17.5 percent. Excluding COVID-related sales, Bio-Rad estimates full-year 2023 non-GAAP currency-neutral revenue growth to be about 4.5 percent compared to its prior expectation of approximately 8.5 percent.

Source: Bio-Rad Reports Second-Quarter 2023 Financial Results

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back